Table of Contents

Man is subject to the passing of time. He comes into existence, grows, becomes old, and passes away. His time is scarce. He must economize it as he economizes other scarce factors. The economization of time has a peculiar character because of the uniqueness and irreversibility of the temporal order.

– Ludwig von Mises

The Ultimate Resource

Human action happens across time. All economic decisions take place across time, and production requires time. Being mortal, man’s time on Earth is scarce, and that scarcity makes it an economic good and gives it value. Time’s irreversible nature makes it a unique economic good. You cannot buy back the time you spent on something, or continue to increase your time indefinitely, as you could with other goods. Mises and the Austrian economists wrote eloquently about the importance of understanding the temporal dimension of human action and the unique nature of time as an economic good. This chapter will also build on the work of economist Julian Simon to argue that human time is the ultimate resource and that economic scarcity is a consequence of the scarcity of human time. The economizing of time is the ultimate economizing act, from which all economic decisions flow. Given more time, humans can make more of any economic good. There are no binding physical constraints on the production of economic goods, and with the dedication of more human time and effort, the output of any good can be increased indefinitely. Only the scarcity of time is what forces us to make choices between economic goods, creating their scarcity. When a child is born into this world, his time in it begins. That time is uncertain. It may be as brief as an hour, or it could last a whole century. Nobody knows how long he will live, but everyone soon realizes it is impossible to live forever, and one’s time will only decline until it runs out completely. With that realization, and with maturity, humans economize time. In contrast to the relative and constantly decreasing scarcity of material objects, human time’s absolute scarcity increases with time. This is intuitively true individually, as growing and aging make man realize that his time on Earth only gets scarcer, giving it more value. It can also be seen in the market price paid for human labor across time. As humans spend more time working and producing, they increase the abundance of material objects, making them drop in value across time, when measured in terms of human labor.

In his book The Ultimate Resource, Simon argues that human time, or human labor, is the ultimate resource because it can be used to make all economic goods and resources. The dedication of time to any production process would lead to an increase in the supply of its output, which leads Simon to argue that using the term “resource” to describe material goods is a misnomer, as material resources are the products of deploying the one ultimate resource, human time, to transform materials that are practically infinitely abundant into useful economic goods. The term “resource” suggests a fixed pool that humans draw down as they consume, but in reality, resources need to be produced before they are consumed, and their production is limited not by their physical abundance on our enormous planet, but by the amount of time humans dedicate to producing them, and their opportunity costs in terms of other goods. Raw materials, metals, and fuels are not given to us as manna from heaven; they are the complex output of sophisticated production processes to extract and deploy them to meet human needs.

Simon’s conception of human time as the ultimate resource clarifies the nature of economic scarcity. Whereas economists had generally posited the scarcity of material goods as the starting point of economic analysis, it would be more accurate to understand scarcity as a function of the finite nature of human time. While material goods are technically scarce on Earth, their absolute quantities within the planet are far beyond our ability to exploit. The amount of raw materials is, therefore, not what makes them scarce. What makes them scarce for us is the time that is required to produce them, since that is limited and constrained in a very vivid sense to us.

Opportunity Cost

The scarcity of time is why humans have to think not just about direct monetary costs associated with any activity, but about its opportunity cost: the cost of an activity in terms of the forgone value of a different activity in which a person could have engaged. The fact that our time is scarce means we cannot engage in all activities at all times. We must choose. Even if physical resources were not a constraint, the time needed to carry out activities is always a constraint, and humans must factor in the alternatives they forego every time they partake in an activity. The inevitability of death, and the finitude of time, and hence its scarcity, necessitate a constant accounting for opportunity cost, and from that comes all of man’s economic thinking and action. All human actions consume time and therefore come at the cost of forgone actions. Understanding scarcity in general as resulting from the scarcity of time helps us understand opportunity cost, and why the economic way of thinking must always include the cost of the forgone alternative. Since human time is scarce, it is valuable to humans. There is thus always an alternative valuable use of time available for an individual, which must be taken into account.

Material Abundance

The most common measure to discuss the abundance of resources is “known or proven reserves,” which refers to quantities of a resource thatare definitively known to exist in particular locations and that can be extracted with current technology and prices. This measure has increased in the long run for every resource known to man. As we consume more of a resource, it gets deployed in more uses, and that creates more demand for it, incentivizing more searching for it, thus increasing its reserves. Simon illustrates how these proven reserves increased between 1950 and 1990 for some important industrial metals. The world’s population in 1950 was around 2.5 billion people, and, by 1990, had grown to around 5.32 billion people. Measured in 2011 dollars, world GDP in 1950 is estimated to have been $9.25 trillion, and $47.04 trillion in 1990. So in a forty-year period in which the human population grew by a multiple of 2.13, and in which human production grew fivefold, the proven reserves of most metals grew, instead of being depleted, and at rates higher than the population growth. Lead proven reserves grew by a multiple of 3, zinc by 4.21, copper by 5.66, iron ore by 8.27, oil by 13.1, phosphate by 14, and bauxite by 16.6.

Clearly, the measure of proven reserves does not serve as a reasonable measure of the Earth’s total resources, but as a measure of the amount of effort we put into the search and exploration of resources. Proven reserves are a measure of how much we are looking for resources using current technologies at current prices. As our exploitation of these resources and our standards of living grow, we develop better tools for digging, and we excavate in more areas, resulting in the growth of these proven reserves. Proven reserves are but the tip of the giant submerged iceberg of the Earth’s total resources, which we cannot ever hope to estimate with any accuracy. Earth is enormous, and its exact composition is very difficult to ascertain from the surface. Digging up the entire Earth to conduct a conclusive inventory is a futile and impossibly expensive job nobody could ever seriously contemplate.

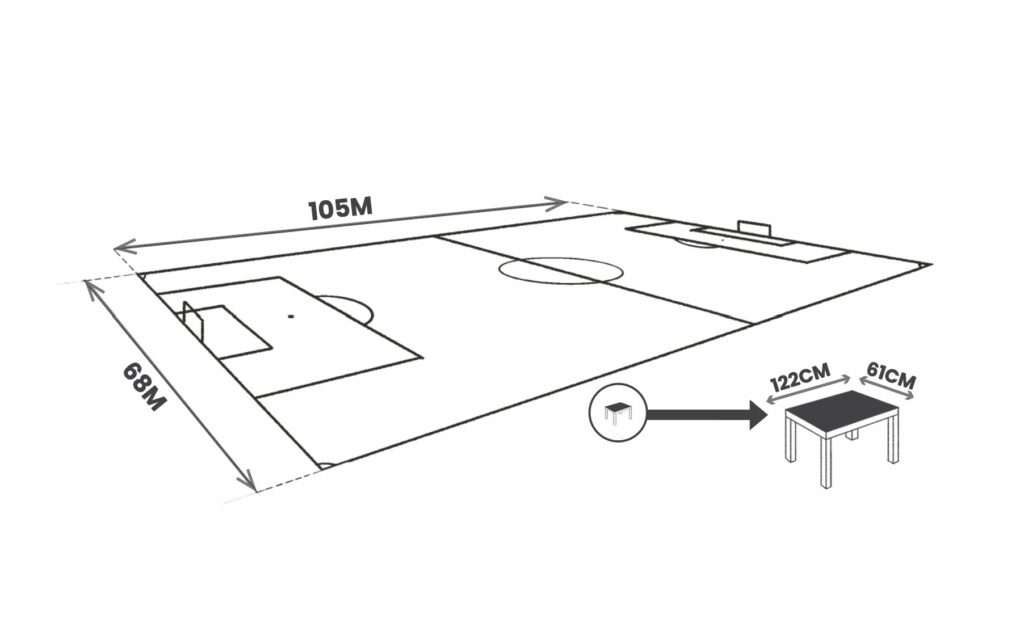

Getting a sense of the magnitude of Earth supports Simon’s contention. Earth’s surface area is 510.1 million km2 , and the total area used for mining between the years 2000 and 2017 was estimated at 57,277 km2, or 0.011% of the planet’s surface area.31 For perspective, if Earth was the size of a soccer field (105m × 68m, or 7140 m2), the surface area of all of the world’s mines would be 0.785 m2, roughly the size of a small desk (a 122 cm × 61 cm desk has a surface area of 0.744 m2).

The diameter of Earth is 12,742 kilometers. By contrast, the deepest mine in the world, Mponeng gold mine near Johannesburg, is “only” 3.16 km to 3.84 km deep, or from 0.024% to 0.03% of Earth’s diameter. For perspective, if Earth was a ball with a diameter of 1 meter (or 3.28 feet), the deepest hole ever dug in its crust would be 0.027 cm (or 0.011 in) deep, less than the thickness of three pages of this book. The vast majority of Earth’s surface has not been dug in search of resources, and in the few places where we have dug, we have, quite literally, barely scratched the Earth’s surface. All of the resources humanity has used in millennia of consumption and exploitation are but a tiny fraction of the bounty available in the superficial 0.027% of Earth’s diameter.

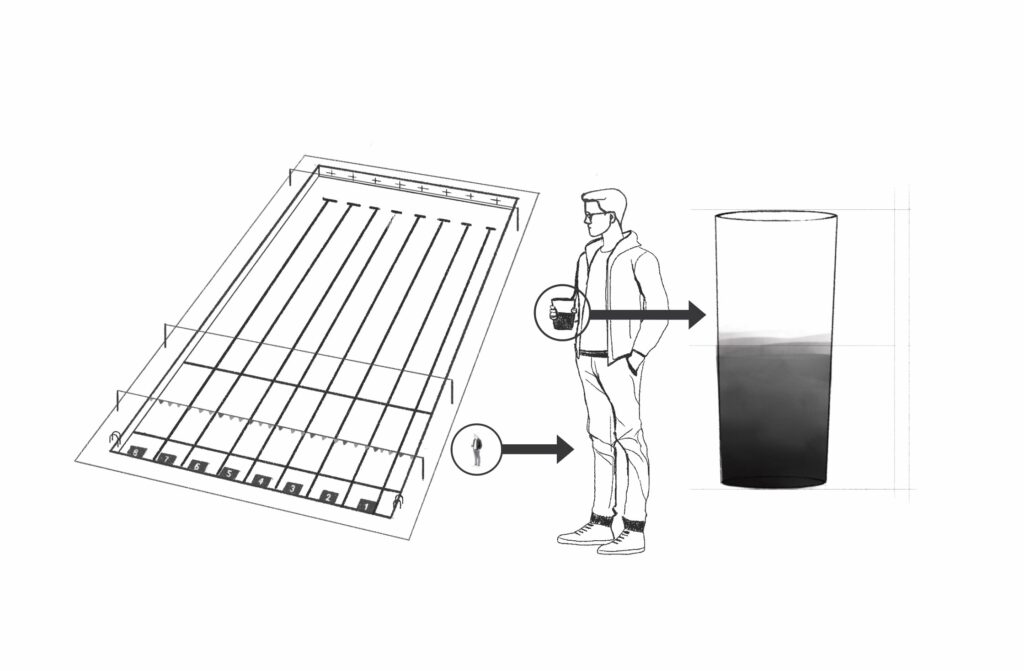

Most mines are closer to 300 meters in depth. For the sake of argument, let us assume a very generous average mine depth of 1 km. This would imply that the total volume of mines in the period between 2000 and 2017 was 57,277 km3. The Earth’s volume is 1,083,206,916,845.80 km3 (around atrillion cubic kilometers). The volume of all the world’s mines is, therefore, 0.00000529% of the Earth’s volume. In other words, the Earth is 18,911,725.8 times larger than all the mines that exist on it, from which we have extracted all our resources. For perspective, if the Earth’s volume was that of an Olympic swimming pool, all the world’s mines would be roughly the size of half a cup.

If all the resources humans consume come from the equivalent of half a cup of the Olympic swimming pool that is Earth, it becomes apparent why worrying about the total amount of resources is so misguided. If eight billion people can subsist on the equivalent of a half cup out of an Olympic pool, it is clear that the total magnitude of water in the pool is irrelevant to human life and all economic considerations. The world’s population would need to double for us to be digging into one cup’s worth of an Olympic swimming pool. Even with enormous growth in the world’s population, we will barely scratch the surface of our vast, bountiful planet. Even the most conservative estimates find that the total crustal abundance of any particular naturally occurring substance is many uncountable multiples of the total amount humans consume of it and that quantity constitutes no meaningful limit or binding constraint on our level of consumption. It is quite likely that the total crustal abundance of any particular metal is equal to millions of years of human consumption. Even if the current, supposedly unsustainable, consumption trends were to continue for thousands of years, we would not be able to dig through the entirety of the Earth’s contents of any particular metal. The limit and constraint on how much we can produce from each metal in any given year will continue to be the amount of time and resources we direct to its production and the amount of other goods and services we are willing to forego for its production.

Beyond being used as an illustration in this economics textbook, these aggregate measures of Earth’s resources are completely pointless and irrelevant metrics that do not factor into the economic decisions carried out by anyone anywhere. There are no economic decisions that pertain to the total stock of metal on Earth, and all individual economic decisions pertaining to a resource are made at the margin, based on the next marginal unit of land to be exploited, the marginal cost of extracting the next unit, and the marginal revenue expected from selling it. At no point can any individual or entity make any economic decision pertaining to the total aggregate stock of a material on Earth. Economic calculations are constantly being done at the margin, and they pertain only to scarce resources that involve an opportunity cost. Minerals in the Earth’s crust are not scarce, and they offer no utility to humans. Producing usable materials from them, on the other hand, requires real decisions to be made about allocating marginal units of scarce resources into the exploration, excavation, extraction, refining, and production processes.

A useful analogy here is to think of Earth’s resources as rocks, and our consumption of resources as the use of rocks to build houses. No economic decision needs to factor in the total quantity of rocks on Earth; economic decisions pertain only to the application of scarce resources, labor, capital, and land, to the process of excavating and applying rocks. It would be insane for a homebuilder to concern himself with the availability of rocks in nature, when all our houses require an infinitesimally tiny fraction of Earth’s rocks for their construction. The only economically pressing concern for the homebuilder is whether he can secure the human labor and human-produced capital that is necessary to convert those rocks into homes.

What we really value are not resources, but economic goods made from resources. That is what requires time, and that is what is scarce. That is the scarcity from which all other scarcities originate. The raw material is everywhere around us, but the time to produce economic goods from it is scarce. Humans are not passive recipients of manna that can run out. Humans are the producers of all these resources, and when demand for these metals increases, the most important determinant of their scarcity is the action of the humans who produce them, and the incentives they face. As they face greater demand for a resource, they have the incentive to produce more of it and invest more in its production. As productivity increases, we are able to obtain larger quantities of the supply of the good per amount of time invested in producing it, meaning that the real price of the good, as measured in terms of human labor, will continue to decline. This fact is borne out by decades of commodity market data.

While commodity prices can and usually do rise in terms of national currencies, that is a result of the debasement of national currencies. When measured against wage rates, or the price of human time, all commodities are in long-term price decline, even as consumption steadily increases. In a world of hard money, as under the gold standard, it would be perfectly normal to expect the prices of all commodities to consistently decline over time, with only occasional and temporary increases precipitated through sharp, sudden rises in supply and production disruptions. Gold, or whatever is used as money, would always be the good whose supply increases at the slowest rate, allowing its holders to command more of all other goods, whose supply becomes more abundant.

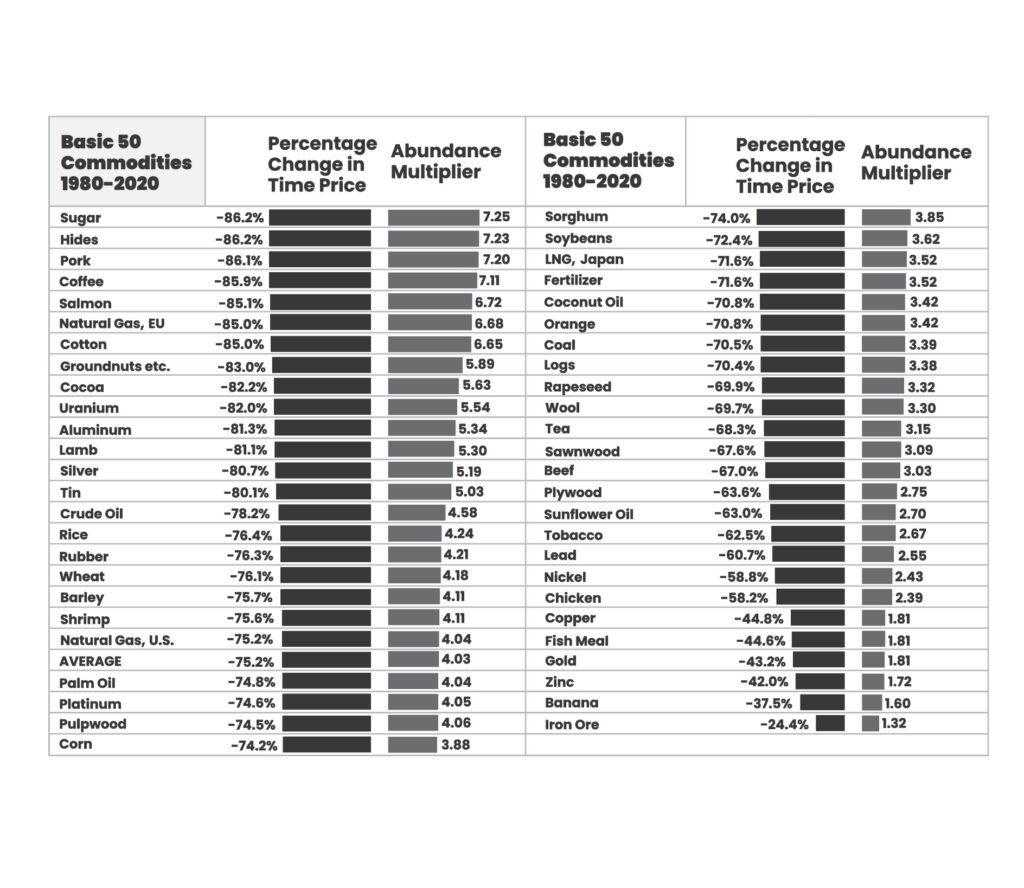

Economists Gale Pooley and Marian Tupy constructed an economic index in honor of Julian Simon that measures the prices of 50 basic commodities in terms of wages. They find that the time needed to earn a basket of 50 commodities has fallen by 75.2% over the period between 1980 and 2020, which means that an hour of work in 2020 could buy 4.03 times as much of the 50 basic commodities as it could buy in 1980, implying an annual growth rate of 3.55% and a doubling of commodity abundance every 20 years.33 Even though the human population increased by 75.8% over these 40 years, decades that witnessed the largest human population growth, and the highest consumption and standards of living in history, the prices of 50 basic commodities have declined by 3 quarters in terms of the human time needed to purchase them. This data is only possible to understand in the context of an infinitely large Earth whose physical limits are nowhere near our grasp, a grasp limited by the scarcity of our time and the opportunity cost involved in increasing the production of any particular resource.

The only scarcity, as Julian Simon brilliantly demonstrated, is the time humans have to produce these commodities, and that is why global wages continue to rise worldwide, making products and materials continuously cheaper in terms of human labor. The one resource whose price has risen almost continuously throughout history is human time, as measured by wages. As we continue to find more ingenious ways of increasing the output of physical resources, their real price, in terms of human time, continues to decline, while the value of human time continues to rise.

Only with this framework can one understand why humanity has never run out of any resource, even after many millennia of exploiting the Earth, and the relentless predictions of imminent doom caused by resource exhaustion. Not only have we not run out of any of these resources, but, in fact, real prices continue to decline, the annual production of virtually all resources continues to rise every year, and the proven reserves of each resource have only increased with time as our consumption has gone up, as mentioned above in Simon’s data. If resources are to be understood as finite, then the existing stockpiles would decline with time as we consume more. But even as we are always consuming more, prices continue to drop, and the technological improvements for finding and excavating resources allow us to find more untapped stockpiles.

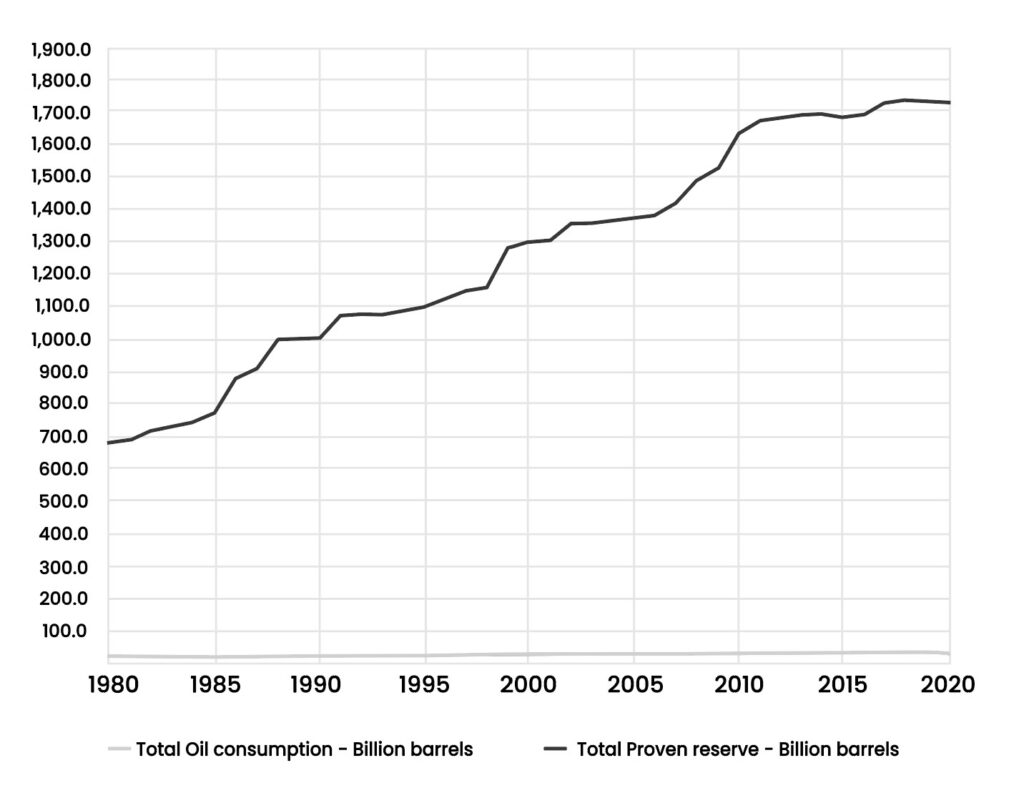

Oil, the vital bloodline of modern economies, is the best example as it has fairly reliable statistics. As Figure 5 shows, even as oil consumption and production continue to increase year-on-year, the proven reserves increase at an even faster rate. According to data from BP’s Statistical Review of World Energy, annual oil production was 46% higher in 2015 than in 1980, while consumption was 55% higher. Oil reserves, on the other hand, have increased by 148%, around triple the increase in production and consumption.

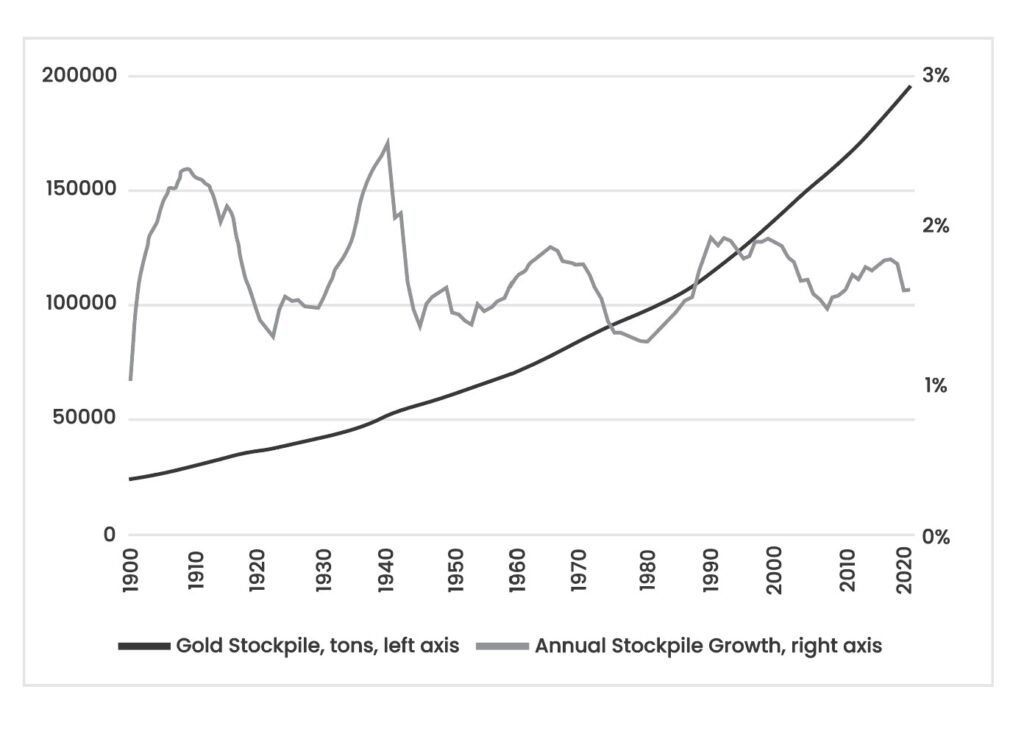

Similar statistics can be produced for resources with varying degrees of prevalence in the Earth’s crust. The rarity of a resource determines the relative cost of extracting it from the Earth. More prevalent metals, like iron and copper, are easy to find and relatively cheap as a result. Rarer metals, such as silver and gold, are more expensive. The limit on how much we can produce of each of those metals, however, and not their absolute quantity, remains the opportunity cost of their production relative to one another, in subjective human valuation. There is no better evidence for this than the fact that one of the (if not the) rarest metals in the Earth’s crust, gold, has been mined for thousands of years and continues to be mined in increasing quantities as technology advances over time.

If there are other metals that are rarer than gold, they have all been discovered recently, and we have not dedicated as much time to finding their reserves and accumulating their stockpiles as with gold. But gold has been sought and mined for thousands of years, and its annual production goes up every year, so it makes no sense to talk of any natural element as being limited in its quantity in any practical sense. Scarcity is only relative to material resources, with the differences in the cost of extraction determining the scarcity.

Simon’s bet

After U.S. President Richard Nixon suspended the convertibility of the U.S. dollar into gold in 1971, all prices began an inexorable rise, a trend that continues to this day. For people in the 1970s accustomed to relatively stable prices under the gold standard, these price rises seemed like a sign of an economic apocalypse, as it gave the impression that all our precious resources were running out. As the world was swept up in the hysteria about the depletion of resources and overpopulation, Simon was not content with merely writing to counter the hysteria. He sought to expose the vacuity of the hysterics by challenging one of the twentieth century’s foremost hysterics, Paul Ehrlich, to a public bet on the question.

Ehrlich had published a large number of hysterical diatribes unworthy of inclusion in this book’s bibliography in which he had predicted the exhaustion of several essential resources to humanity due to overpopulation and added trademark misanthropic rants about eugenics and coercive sterilization and other measures to reduce the human population. Simon challenged Ehrlich to specify any resources he was confident would run out or become much scarcer over any period longer than a year, and Simon would bet him $1,000 that each of them would actually be cheaper, in real terms, by the end of the period.

The bet must have seemed like a donation to Ehrlich, such was the conviction of his warnings about the imminent depletion of critical resources. Ehrlich specified 5 metals and a period of 10 years to assess their price, from 1980 to 1990. By the end of the period, each of these metals was cheaper than at the start in real terms. Thirty years later, these metals have only gotten cheaper in real terms, while their annual production continues to increase every year.

The reason that the price of all these metals dropped is that their scarcity is relative, not absolute. They are scarce to us because the time and resources required to produce them must be diverted away from the production of other resources. Simon understood that as the human population increased and demand for these metals increased, these metals would have more resources directed toward their production, their quantities would increase, and their prices would decrease. The rise in demand causes a rise in prices, which affords larger profits to producers of these metals, which provides them with more money to spend on investment, and allows them to attract more investment. This investment goes into prospecting, extracting, refining, and distributing the metals, all of which leads to an increase in productivity, the output per unit of input. As will be discussed in more detail in Chapter 4, larger capital investments allow the employment of more complex and longer methods of production that yield a higher productivity per worker.

As a geologist, Ehrlich’s conception of scarcity was based on estimates of consumption compared to reserves, without regard for the role of human action in bringing about changes in these numbers. Ehrlich essentially compared the proven reserves of metals to their annual consumption numbers and estimated the number of years it would take humanity to run through its reserves.

Simon, as an economist, understood the dynamics driving the production of these metals, even though he had little familiarity with the geological realities. By understanding economics as the study of human action, as discussed in Chapter 1, Simon knew that the scarcity of these metals depended ultimately on the amount of time humans dedicated to them, and that was, inturn, dependent on the incentive humans had to produce these resources, not on geological limitations. Should the demand for a metal increase, there is no limited pool to be depleted. There are always other lands to prospect and deeper mines to dig.

Time Preference

Human time being finite and uncertain means that no person knows with certainty how long they will live, or when they might die. This creates in man a time preference, a universal preference for earlier over later satisfaction. Individuals always prefer consuming or having a good today over any future period, because survival is never certain. Time preference is always a positive value, meaning that utility today is always preferred to the same utility tomorrow. Humans also prefer to have resources sooner rather than later, since, in the case of durable goods, they would be likely to enjoy their services for longer the earlier they receive them.

While time preference is always positive, its value varies depending on the degree to which humans discount future utility compared to present utility. A relatively low time preference indicates a low degree of discounting of future utility, indicating a relatively greater concern with the future. A higher time preference implies a higher degree of discounting of future utility, a relatively lower concern with the future, and a strong present orientation.

Economizing Time

As discussed above, economic scarcity is ultimately the scarcity of human time. We can then also understand the entirety of human economizing as centering around economizing time. That is, we seek to increase the amount and subjective value of our time on Earth. That time is scarce means humans are constantly looking to economize it into being spent in the ways that offer them the most satisfaction, or that are the most valuable. The future being uncertain and time preference being universally positive mean that humans constantly seek to maximize the value of their present time.

Leisure is the term used to denote the time people spend doing things they enjoy for their own sake, things that bring them immediate pleasure, as opposed to things they do in exchange for a future reward or satisfaction. Leisure is how economists refer to good times. Everyone likes to have a good time. Life is finite, and humans naturally want to spend it doing the things they enjoyrather than the things they do not enjoy. Time preference, in other words, is always going to be positive.

Everyone would like to spend all their life in leisure. But since we are not eternal creatures living in the Garden of Eden, too much leisure will inevitably mean an early death through starvation or the forces of nature. We also cannot just enjoy leisure indefinitely, because we are always capable of conceiving of ways in which we can improve the quality and quantity of time we have on Earth. It is not just the value of our present time that humans seek to economize. We would also like to maximize the quantity of time we have on Earth; in other words, try to live long lives and not die early. We would also like to maximize the value of our future time. Human reason allows us to conceive of ways to act to increase our chances of survival and to provide for our future selves. Reason allows us to conceive of a better future, to work for it, and to sacrifice present enjoyment for its sake. Reason also allows us to conceive of the consequences of failing to provide for the future, and to compare them to other courses of action. Humans can spend every minute of their lives caring only about their present, but they would eventually arrive at a very precarious present moment because of their failure to have provided for it in the past. The more an individual values the future and works and provides for it, the more likely they are to survive into the future.

Ultimately, the economic question is how we trade off present utility against longer survival and future utility. The most important trade an individual conducts is their trade with their future self. The simplest trade is the one involving forgoing immediate pleasure in favor of labor to provide for the future. As a person is enjoying their present, they will experience a need for sustenance and shelter, at the very basic level. But food needs to be hunted, grown, or acquired, and shelter needs to be built or acquired. That requires the sacrifice of present enjoyment in favor of labor.

Man’s reason leads him to realize he can provide for his future self and improve his chances of survival. He understands that labor, while unpleasant in the moment and involving the cost of forgoing pleasure, will allow him to reap the rewards in the future. Reason, and the desire to live long and well, conspire to lower man’s time preference. They call on him not only to abandon leisure in search of the hardships of work, but also to provide for his future self through deferring current consumption, saving for the future, and accumulating durable goods and productive capital.

It is this process of lowering time preference, future orientation, and provision for the future that sets in motion the process of civilization. Or, as Hans-Hermann Hoppe put it, “once it is low enough to allow for any savings and capital or durable consumer-goods formation at all, a tendency toward a fall in the rate of time preference is set in motion, accompanied by a ‘process of civilization.’”

As humans reap the benefits of future provision and low time preference, they become more likely to engage in it. Work, and the accumulation of capital, lead to increases in productivity, increasing the value of an individual’s time. The more people are able to provide for their future, the less uncertain it becomes, which in turn encourages further concern for the future, saving, capital accumulation, and a likely increase in the quantity and the value of an individual’s time on Earth.

Economizing Action

There is no opting out of economics and economic choice except through death. You may not like specific institutions such as private property or labor, but choosing to not engage in them simply excludes you from larger, more productive circles of economic activity. If you are alive and you strive to remain alive, you are bound to seek to survive through the tools of economizing action. Everyone engages in economizing acts every day of their lives without having to learn economics. But learning economics can help the mind consciously understand the importance of acts in which it engages, and how complex structures and institutions emerge from them. While learning economics is not necessary for economizing, which is a natural function of our reason, it is necessary for the fostering and survival of an extended market order in which humans are able to economize freely, cooperate with one another, and prosper. Individuals are capable of engaging in market transactions but can lose sight of their importance, resulting in political structures that suppress this type of economic action, with devastating consequences.

The following nine chapters of the book will each focus on important tools we humans have developed, consciously and spontaneously, to increase the quantity and value of our time. This list is not meant to be exhaustive or conclusive, and these categories contain significant practical overlaps, but this book will still focus on explicating each of these concepts individually. They are listed below alongside their chapter numbers:

4. Labor

5. Property

6. Capital

7. Technology

8. Power

9. Trade

10. Money

11. The Market Order

12. Capitalism

These tools are, in essence, how we humans economize our time. The ultimate trade-off we all face is that our time can be spent on leisure, enjoying things we like, or it can be spent on economic activity, with the aim of increasing the length and value of our time. All of these economic tools share one thing in common: they are peaceful, and everyone involved does so of their own volition. Chapter 16 discusses non-peaceful means of human interaction, and Chapter 17 discusses how humans defend these forms.