Table of Contents

Wherever we turn among civilized peoples we find a system of large-scale advance provision for the satisfaction of human needs. When we are still wearing our heavy clothes for protection against the cold of winter, not only are ready-made spring clothes already on the way to retail stores, but in factories light cloths are being woven which we will wear next summer, while yarns are being spun for the heavy clothing we will use the following winter. When we fall ill we need the services of a physician. In legal disputes we require the advice of a lawyer. But it would be much too late, for a person in either contingency to meet his need, if he should only then attempt to acquire the medical or legal knowledge and skills himself, or attempt to arrange the special training of other persons for his service, even though he might possess the necessary means. In civilized countries, the needs of society for these and similar services are provided for in good time, since experienced and proven men, having prepared themselves for their professions many years ago, and having since collected rich experiences from their practices, place their services at the disposal of society. And while we enjoy the fruits of the foresight of past times in this way, many men are being trained in our universities to meet the needs of society for similar services in the future.

– Carl Menger

The previous chapter presented the concept of property in economic terms and discussed the development of this human tool over time. Of the forms of property humans can own, economics makes a distinction between consumption goods, which are owned for the utility they offer their owners, and capital goods, owned not for their utility but because they can be used to produce consumption goods that offer utility. Capital goods, or higher-order goods, are any goods that are not consumed but used for the production of consumption goods or lower-order goods. What makes a good a consumption good or capital good is not inherent to the good itself but is a function of how the good is utilized by the person who owns it. The same good can be used as a capital or consumption good, depending on the context. A computer used for watching movies and browsing the web is a consumption good, but the same computer used to write a book is a capital good. A car can be a capital good if operated as a taxi, but a consumption good if used purely for recreational travel. Grains of corn can be a consumption good if eaten but a capital good if planted to grow more corn.

This chapter discusses capital conceptually in an abstract sense. After introducing money and the extended market order in the forthcoming chapters, Chapter 12 will discuss capital in the context of a modern monetary economic order, and Part IV of the book will discuss the problems of central planning in capital markets.

Lengthening Structure of Production

The introduction of capital into economic production necessitates the lengthening of the period of production. Without capital goods, man engages in the production of the final consumption good directly, but when a capital good is involved, man needs to first produce the capital good and then use it to produce the consumer good. By adding an intermediate stage of capital production, the process of production from start to finish becomes longer.

This might initially sound counterintuitive. Why would humans engage in longer processes of production? Time preference is positive, as discussed in Chapter 3; humans prefer the same good sooner rather than later. Why spend hours building a fishing rod to catch a fish when you can just catch fish directly with your hands in less time? The answer lies in the productivity of the fishing rod. While producing the fishing rod takes time, once it is completed, its use should hopefully allow the fisherman to catch a larger amount of fish per unit of effort. Even though the immediate investment in manufacturing a fishing rod delays the arrival of the fish, the increase in productivity makes its long-term output more valuable than the smaller output from fishing with your hands, which arrives sooner. The success of this investment is not guaranteed, but the potential extra reward is the only motivation for engaging in capital accumulation, lengthening the process of production, and forgoing closer need satisfaction.

Should a man choose to catch fish with his hands, the period of production would last from the moment he began heading to the sea to catch the fish until the moment he caught it. Assume this process takes two hours. There is no faster and more direct way of catching fish, but there are more productive ways, albeit ones with longer production processes. Should the man engage in producing a fishing spear, the time required to find a suitable branch, sharpen it, and learn to use it would now lengthen the entire production process. We can reasonably assume that the time from initiating the search for the stick until the fish was caught would now be 4 hours instead of 2. However, once the fish was caught, the fisherman’s spear would still function, and catching the next fish would take much less time than the 2 hours, on average, that it used to take the man without the spear. The entire production process would become longer, but once the capital was produced, the marginal time needed to produce an extra unit would become shorter. As the process of capital accumulation intensifies in fishing, the production process just becomes longer: The fisherman builds a small boat, which requires an entire week of production before he can use it to catch a single fish, but once he can start catching fish with it, it appreciably increases the fisherman’s marginal productivity. As capital accumulation continues to proceed, the fisherman could build a large boat that requires an entire year of production before it yields a single fish.

Saving

The sine qua non of any lengthening of the process of production adopted is saving, i.e., an excess of current production over current consumption. Saving is the first step on the way toward improvement of material well-being and toward every further progress on this way.

– Ludwig von Mises

Lengthening the period of production cannot take place without initially providing the consumer goods needed to sustain the producers during the production process. Providing for the future makes it possible to engage in production processes that are longer and more productive. But man can save resources to provide for the future only if he is able to meet his current needs. The farmer must produce enough grain to feed himself before he can plant any grain, and every grain he plants is a grain he cannot consume this year. If the fisherman is going to spend a day building a fishing rod, he must already have provided for this day from his previous day’s production by delaying consumption that was possible the previous day. It is impossible to engage in building a fishing rod without forsaking time away from leisure, which has positive utility, or from labor, which produces consumer goods with positive utility. Saving is the mother of capital; only by deferring consumption can capital goods exist.

The same is true even in the longest and most sophisticated production processes, such as that of creating an airplane. Today there are engineers designing the next line of airplanes for Boeing that will likely need more than a decade of design, production, and testing before they can be sold to generate revenue for the company. The airplane maker requires capital investment to provide these workers with the resources necessary to sustain them before the production process can be completed and the company can generate revenue from the sale of the planes, in addition to compensating the owners of the capital stock that will be used in the production process. Time preference is positive, and capital owners and laborers need to consume during the production process to survive and part with their capital or labor. Even if Boeing were somehow able to procure all the capital equipment and labor it needed by promising to pay the workers and equipment sellers when the airplanes were completed, the production would have been financed by the workers and equipment sellers, who would have had to delay gratification to produce.

To lengthen the production process, someone somewhere must forego the consumption of resources in order to provide them to the producers. In the simple fisherman’s economy, that sacrifice was made by the fisherman himself when he saved some of the previous day’s food for the subsequent day, so he could spend time building a fishing rod. In a modern capitalist economy, the sacrifice is made by investors who forego consumption to provide financing to entrepreneurs. The entrepreneurs compensate the workers and the owners of capital, in the present, for providing their labor and capital for his production process, whose output will materialize in the future. Not only does a longer production process require more delayed gratification, but it also requires more cognitive skills and can incur more risks. Without an entrepreneur imagining a longer structure and an investor sacrificing present satisfaction for the chance of a larger future return, the capital and labor resources needed for the production process cannot be procured. Every process that lengthens production is only possible because of the sacrifice and delayed gratification made by capitalists. This seemingly obvious point is worth reemphasizing because a sizable portion of the world’s economic problems have come from cranks laboring under the delusion that they have found an exception to this necessity.

Higher Productivity

Ludwig von Mises described capital goods as “labor, nature, and time stored up.” He made a distinction between capital and independent factors of production, nature-given material resources, and labor. This mental framework is very useful for understanding the economic function and significance of capital.

Humans are able to take nature’s given resources, combine them with their labor, and over time produce capital goods as an output. The time, labor, and resources that went into making the capital good will then result in higher productivity.

Producing using capital goods can be thought of as producing with the aid of the labor, nature, and time that went into making the capital good. This results in an increase in productivity, allowing the production of one unit of the final output to take less time than it would have taken without capital. Time is spent on longer processes of production to achieve higher outputs per unit of time, which is why capital is another way of economizing on human time, as Mises explains: “The difference between production without the aid of capital goods and that assisted by the employment of capital goods consists in time… He who produces with the aid of capital goods enjoys one great advantage over the man who starts without capital goods; he is nearer in time to the ultimate goal of his endeavors.”

It is important not to confuse the longer period of the entire production process with the shorter production time of the final good. Accumulating capital leads to an increase in the total time taken to produce goods when including the higher-order goods that go into the process. However, it also results in a decrease in the production time of each marginal unit. Beyond just increasing productivity, capital goods allow for the production of goods that were entirely impossible without capital. As the fisherman goes from catching fish with his hand to using a fishing rod or fishing boat, not only will he have a higher output, but he will also be able to catch species of fish that were not within his reach before he had the capital. Without capital accumulation, most of the products we take for granted in the modern world would not be possible, as there is no way to produce them with our bare hands.

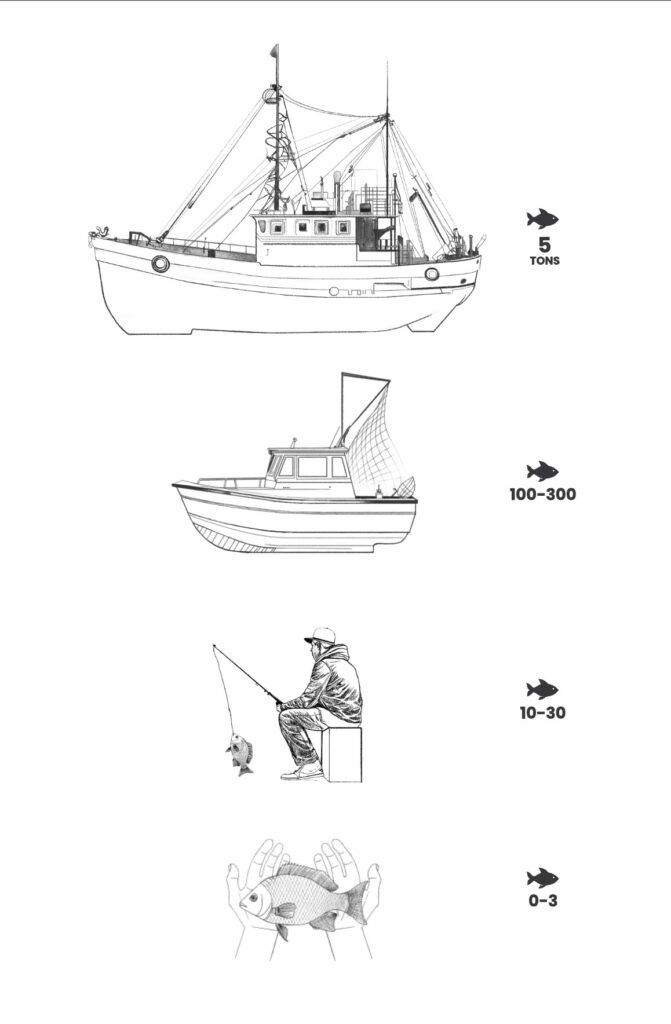

Capital goods are built and acquired to increase the productivity of labor, and in the process, they inevitably make the entire production process longer. Capital is the difference between fishing with your bare hands and fishing with a fishing rod, a small fishing boat, or the Annelies Ilena, the world’s largest open-sea trawler. A day spent fishing with your hands will produce a few fish, if you are lucky. With a fishing rod, you could catch around a dozen fish a day; and with a fishing boat and net, a few hundred. On the other hand, if you were one of the approximately 70 crew members of the Annelies Ilena, you would collectively produce approximately 350 tons of fish every day, or around 5 tons of fish per worker per day. The same human being, spending the same number of hours during the same day, could catch one fish or 5 tons of fish, depending entirely on the capital he is able to deploy to the task.

This increase in productivity is what ultimately drives the disparity in living standards between people who can work with large amounts of capital and people who cannot, between people who fish with their bare hands and those who fish with the Annelies Ilena, between countries with a large amount of industrial capital and those without.

This increased productivity is what makes our modern life possible. As a thought exercise, try to imagine securing your survival without using any capital goods. If all production processes were to be carried out with your bare hands, survival would be a very difficult ordeal. It would be uncertain whether you could secure enough food for your daily survival from foraging or hunting. A shelter built only by hand would be flimsy and vulnerable to destruction by nature. Under such conditions, survival would be uncertain. However, were you to survive, it is almost inconceivable that you would not recognize the enormous value of investing in the production of goods that increase the output of your time spent in production processes. The inevitable need to resort to using rocks and tree branches to fight off animals, or trying to hunt them, is itself a form of capital use. Individuals and ideologies that decry the evils of capital are impotently and ignorantly railing against the inevitability of the human mind resorting to using tools to achieve its ends.

Should these investments succeed in raising your productivity, securing a day’s food becomes less demanding and uncertain. Less time needs to be dedicated to securing basic survival, and more time can be directed toward investing in more capital production to increase productivity further.

The surest and most important way of increasing human quality of life is through the accumulation of capital goods, because they serve to increase work productivity. There is no guarantee that investing in capital will result in increased productivity, and that is the risk inherent in the process of capital accumulation. But if investment yields capital that does not result in increased productivity, then the investment fails and its outcome will not be deployed as capital. It will be consumed if it can be, or otherwise discarded. There have, undoubtedly, been many attempts at producing capital goods that increase the productivity of fishing, but only the ones that succeeded remained. All the others have long been forgotten, and the investment that went into them wasted. Capital is not just the product of any investment in lengthening the production process; capital consists of only the investments in the lengthening of the production process that yield higher productivity. The risk of waste is but one facet of the high cost of capital.

The longer the production process, the more capital is deployed successfully, the higher the productivity of labor, the less of a day’s labor needs to be dedicated to securing basic survival, and the larger the margin of safety separating man from starvation. It is primarily thanks to capital accumulation and longer production processes that most of the world’s population can buy nutritious food for a fraction of a day’s wages. Without modern capital, the output of a day’s work would be in the rough range of what an individual needs to survive for a day, making existence precarious and uncertain. Extreme poverty today exists only where capital is scarce, and people need to work daily to survive. With modern capital, on the other hand, most workers can produce several multiples of their food needs every day, providing them a considerable margin of safety to protect them from destitution and starvation and allowing them to consume many other goods.

To understand the importance of capital, try to perform your job without any capital, and measure the change in your productivity. If you are a farmer, try farming with only your bare hands and no tractor or shovel to help. Try hunting without a rifle, spear, or bow and arrow. Try to be a taxi driver without a car. Try to survive a winter without the capital equipment we use to build our modern homes, warm them, and protect them from storms. It is accurate to think of poverty as the lack of capital.

A good literary illustration of the value of capital comes from George Orwell’s Down and Out in Paris and London. Orwell spent a lot of time with low-income workers in both major European cities in the 1920s and ’30s. One of his most astute and profound observations about the state of poverty in which he lived was how expensive everything was for poor people. A rich man who has a home with all the essentials of survival can take survival for granted on any given day, at least when compared to what a poor tramp has to persevere in order to secure his basic needs. Without a kitchen, every meal is expensive. Without a car, walking is very time consuming. Without a wardrobe, it is expensive to find decent clothes to look good for a decent job. Many things are made cheap by owning the capital, and capitallessness is a prime reason why poverty can appear insurmountable. Low stocks of capital induce low productivity, and that, in turn, leaves very little income for saving and investing in capital to raise productivity. Breaking out of this cycle requires the deferral of consumption when consumption is already very small, and survival is precarious. Many of the world’s poor have struggled to break out of this poverty trap.

The High Cost of Capital

It is common to hear capital and its owners mentioned disparagingly in mainstream media, academia, and other fountains of economic illiteracy. Capital is presented as if it is a means of exploiting labor, and its owners the beneficiaries of an unfair advantage over the rest of society. Rarely does one hear the true costs required for capital ownership and the responsibility it implies. To be a capital owner, you first have to earn it. Then you have to abstain from consuming it by saving it. Then you have to deploy it in the market well enough to earn a return sufficient to maintain it. The economic cost of capital manifests in several ways:

Delayed gratification

The drawback of capital accumulation is that it is expensive and uncertain. It requires sacrificing present consumption in order to invest resources that will only bear fruit in the future and may not bear fruit at all. Capital requires the constant delay of gratification and deferral of consumption. The opportunity cost of capital is always forgone consumption. Any person who owns any capital is at any point in time capable of selling the capital in exchange for present consumption goods. The moment his fishing rod is completed, the fisherman could find someone to pay him a significant sum of fish in exchange for the rod. In order to continue to produce at the more productive level allowed by the fishing rod, its owner must every day reject the chance to accept a sum of fish in exchange for it. Every productive machine on the planet could be sold by its owner in exchange for consumer goods that give him more immediate pleasure. The owners of the Annelies Ilena could live outrageously well over the next year if they sell it and spend the proceeds, but they continue to sacrifice that splendid year in favor of maintaining capital that will produce a stream of income for decades into the future.

For any capital accumulation to occur, individuals must lower their time preference; they must reduce their discounting of the future enough to provide for it at the expense of the present. This point is worth bearing in mind when economic illiterates rail against capital owners for being parasites on the workers. The sacrifice of present consumption by capital owners in exchange for future reward is economically no different from the sacrifice of leisure by workers in exchange for future reward. Had capital owners actually contributed nothing to the production process, then their consumption of the capital good instead of offering it to the workers would make no difference to the workers’ productivity. But ask any worker what would happen to their productivity without capital, and the absurdity of hating capital becomes apparent.

It is worth noting that neither the Marxist nor Keynesian economic schools of ill-thought have ever developed the intellectual capacity to deal with a concept like time preference, and what it implies for capital accumulation. Nor have they ever demonstrated a grasp of the concept of opportunity cost, as is apparent from their policy proposals, which are made for a Garden of Eden that has no scarcity, and forces no choices on governments or individuals. No appreciation of the difficulty and importance of capital accumulation can be obtained without understanding scarcity and opportunity cost, and that helps explain why socialist governments culminate in the wholesale destruction of society’s capital.

Destruction

Producing capital is expensive and uncertain, and destroying capital is very easy. Capital is similar to a living organism that needs to be continuously receiving inputs from, and producing outputs into its environment to survive. It needs to operate in a market where prices dictate its most productive uses and modes of production. Prices inform capitalists as to where to allocate their capital, and they inform entrepreneurs as to how to manage production processes. Without free markets, prices give no signals to capitalists or entrepreneurs on where and how to allocate their resources, leading to misallocation, waste, and a decline in capital stocks. Without being employed and properly maintained, machines malfunction and deteriorate. Disruptions to production processes can cause very expensive, and often irreparable damage, to capital goods. It takes a lot of time for our fisherman to build his fishing boat, but it only takes a few seconds of losing control of the boat for it to crash onto a rocky shore and disintegrate into irreparable pieces. This is equally true for the small fishing boat and the giant open-sea trawlers.

Depreciation

It is also the nature of capital to depreciate over time as it gets used. Capital is not eternal, and its employment and daily wear and tear will take their toll on it. Producers who invest in capital cannot expect it to keep producing consumer goods indefinitely at the same level of productivity. The productivity of capital constantly declines with use, and more capital expenditure is needed to maintain capital and its productivity. The fishing spear going into the sea’s salty water degrades and becomes less effective with time. The small fishing boat deteriorates with use and over time, and it requires the investment of more time in repairing it. The most advanced modern trawler requires constant maintenance to remain operational, and it will have a large team of engineers and workers specialized in maintaining its operation, constantly inspecting critical parts, replacing worn ones, oiling the gears, and refilling it with the fuel it needs.

Risk

Capital accumulation is also inherently risky and uncertain. On top of the risk of destruction discussed above, there are countless reasons why capital could fail to produce the desired quality and quantity of final goods. Capital is at risk of being rendered obsolete by the invention of newer products and newer methods of production. Through no fault of her own, an entrepreneur may find her entire investment rendered obsolete when a competitor develops a superior product to hers, or a much cheaper way of making a product. Capital accumulation not only requires the sacrifice of the present for the future, but it also requires the sacrifice of the certain for the uncertain. The capitalist is constantly speculating that her investment will yield a positive return in the future, but she could always be wrong.

In order to become a capitalist, one needs to first produce something of value for which others can pay him. He then needs to abstain from using that payment to satisfy his own needs, and instead deploy it into a business whose goal is to serve others, by producing outputs, which they subjectively value higher than the market price of the inputs into the production process. At any point in time, failure to provide customers with this value will result in a collapse in revenue and profitability, inevitably leading to bankruptcy and the loss of capital. The causes of such failure are endless: laziness, disinterest, bad luck, better competitors, but the outcome is always the same: the loss of capital.

These are the reasons why capital ownership is so valuable and productive and why workers continue to choose to work for capital owners. As Murray Rothbard put it:

[I]f they wanted to, all workers could refuse to work for wages and instead form their own producers’ cooperatives and wait for years for their pay until the products are sold to the consumers; the fact that they do not do so, shows the enormous advantage of the capital investment, wage-paying system as a means of allowing workers to earn money far in advance of the sale of their products. Far from being exploitation of the workers, capital investment and the interest-profit system is an enormous boon to them and to all of society.

The extent that an individual owns capital in a free-market economic system is the extent to which he is able to serve people enough to maintain his capital. No privilege or inheritance is above this, and no wealth too large.

Fail to serve customers, and your capital will depreciate until it becomes dysfunctional junk requiring disposal. Owning capital, as Mises explained, is a responsibility, and a liability, not a privilege:

Capitalists and landowners are compelled to employ their property for the best possible satisfaction of the consumers. If they are slow and inept in the performance of their duties, they are penalized by losses. If they do not learn the lesson and do not reform their conduct of affairs, they lose their wealth. No investment is safe forever.

Modern schools of economics do not teach the reality of economics as the study of human action, which results in their adherents being incapable of understanding the hard work, sacrifice, and risk needed for anyone to become a capital owner. This inability to understand cause and effect leads to imagining capital as some sort of heavenly privilege bestowed upon a particular race of people. You either belong to that race or you do not. There is little appreciation or understanding of the actions necessary to accumulate capital and hold on to it successfully, and as a result, many people waste their time, and the fruit of their labor, complaining bitterly about capital, rather than working to acquire it and raise their productivity and living standards. This economic ignorance is the wind in the sails of demagogue politicians who exploit it to achieve power and use it to expropriate capital owners.

The denigration and vilification of capital ownership by Keynesians and Marxists and their inability to understand the costs needed for capital accumulation has meant that governments under the influence of these ideologies have too often attempted to finance investment without preexisting savings. Whether it is through printing physical money or credit expansion, the underlying delusion is the same: Creating claims on capital can replace the need for saving to produce capital. This dynamic, and its disastrous consequences, will be studied more closely in Part IV of this book.

Capital and Time Preference

Once it is low enough to allow for any savings and capital or durable consumer-goods formation at all, a tendency toward a fall in the rate of time preference is set in motion, accompanied by a “process of civilization.”

– Hans-Hermann Hoppe

The cost of capital accumulation lies in the sacrifices of present goods that must be undertaken in order to invest resources in the production of future goods. The more that people value the present compared to the future, i.e., the higher their time preference, the less they will be inclined to defer consumption and invest in future production. As their time preference declines and their valuation of the future increases, they become more likely to forego present consumption in search of future returns. As far as anyone knows, capital goods cannot be conjured out of thin air by visualizing or wishful thinking. The only way of making capital goods lies in the deferral of the consumption of present goods. Like all economic phenomena, capital can only be understood in terms of human action, and the action needed to make it happen. The constraint on capital accumulation is not natural or physical; it is human and lies precisely in how much of their output humans want to invest in future production versus present consumption; in other words, the constraint on capital production is time preference. As Hoppe explained, “the lower the time-preference rate, the earlier the onset of the process of capital formation, and the faster the roundabout structure of production will be lengthened.”

Seeing as time preference is the limit on the production of capital, it, therefore, follows that the price of capital is a reflection of time preference. The lower a person’s time preference, the less they discount the future compared to the present, and therefore the cheaper it is for them to sacrifice the present consumption for future reward. When a person’s time preference is high, on the other hand, the sacrifice of present consumption is going to appear very costly compared to future reward. The price of capital is thus a negative function of time preference. This is the intuitive basis for the pure time preference theory of interest rates, which will be discussed in detail in the last section of this book, after introducing money, entrepreneurship, and the monetary market economic order in the forthcoming chapters.

Since time preference is positive, only the expectation of a positive real return encourages saving. The value of capital goods is derived entirely from the goods they produce; capital has no value independent of its product because it offers no direct utility to humans as a consumer good; it has utility only to the extent that it can produce goods with utility. Only investment in activities which offer a positive return in terms of utility and final goods is undertaken. As Rothbard put it:

We may explain the entire act of deciding whether or not to perform an act of capital formation as the balancing of relative utilities, “discounted” by the actor’s rate of time preference and also by the uncertainty factor.

When a man values the future output of the production process, discounted for their time preference and uncertainty, at a higher value than the initial investment equired, he is likely to invest and build or acquire capital goods. Should the investment succeed, he can use more of the resources to acquire more capital goods, increasing his profits and productivity further. In turn, as the stock of capital and productivity increase over time, he becomes less uncertain about his financial future, and that lowers his time preference further, encouraging more capital accumulation. As more capital is accumulated across society and time preference declines, the price of capital (determined by interest rates) also declines. This process of lowering time preference and increasing investment can be understood as the process of civilization.

Saving Fallacies

Any modern economics textbook will have little focus on the process of capital accumulation. When people think of a capitalist system, they are more likely to think of free trade as its hallmark, rather than capital accumulation. International development organizations promoting economic growth in developing countries also emphasize the role of trade and countless trade policy reforms, but place little value on capital accumulation. To the extent that capital accumulation is mentioned, it is used as a pretext for justifying public and private borrowing, as though that would be the equivalent of accumulating capital, when it is, in fact, the exact opposite. International financial institutions have a vested interest in generating more loans for developing countries, but not much of an interest in watching domestic savings grow.

There is very little discussion of savings in modern economic textbooks, particularly with regard to the essential role of savings in generating economic production. Saving financial instruments, instead of spending them, is no different from saving economic resources from present consumption in order to deploy them in economic production, or from delaying the enjoyment of leisure and engaging in labor. There is also no discussion of the inescapable need for saving to precede investment. Rather than emphasize the commonality of delaying gratification in all of these acts, and their indispensable role in economic growth and progress, the typical Keynesian textbook portrays savings as an antisocial and borderline sociopathic personality trait.

The starting point of Keynesian analysis is to assume that society’s income will be divided into spending and saving according to a predetermined mathematical formulation. There is little discussion of the factors that determine the level of saving in a society. There is no recognition of the importance of human agency in making this choice, and no discussion of its consequences. The Keynesian model uses a highly contrived definition of savings, whose explication and debunking are not worth including in this book in more than a footnote. Suffice it to say that after extensive definitional and mathematical shenanigans, the Keynesian analysis concludes that equilibrium is reached only when the quantity of savings equals the quantity of investment, even though these are two completely distinct concepts and accounting entries, and there is no reason for them to be equal, other than by coincidence. But, according to this model, when aggregate savings exceed aggregate investment, that must mean society is not consuming enough, or, in other words, is saving too much. Under the Keynesian model, when people decide to stop spending a lot and instead save and hold on to cash, the economy slows, causing widespread unemployment and bankruptcies.

The Keynesian textbook implicates savings for damaging the economic order and causing unemployment. It does so based on a deference to Keynes’ authority and through the application of more recent completely invalid mathematical equations and models. It also concludes savings would prevent the market from recovering as the economy falls into a deflationary spiral, with less spending causing less employment, which in turn causes less spending in a never-ending downward spiral. Such an absurd scenario is understandable since Keynes had no comprehension of how prices function and adjust in a market economy, where final products are discounted and sold off, and unprofitable factors of production are deployed in new, more productive lines of production. But according to Keynes, markets would fail to adjust if people continued to selfishly look out for their own self-interests by saving, rather than doing the responsible thing and spending.

According to Keynesians, only the omnipotent and omniscient hand of coercive government intervention could rescue the market from the catastrophe that low-time-preference savers had inflicted upon it by providing for their future at the expense of the present. By devaluing the misers’ savings to finance credit expansion and fiscal spending, the government would, at once, be able to increase the aggregate level of spending in society, increase the amount of investment, reduce the level of savings, and, for good measure, teach savers a lesson and set a precedent that discourages them from saving in the future. The assumption is that, through central planning, all things are possible. This was, after all, the doctrine of a man whose time preference was so high, who cared so little for the future that he made his motto “In the long run, we are all dead.” Given that saving is a means of providing for the future, Keynes never failed to denigrate it, discourage it, and seek to undermine it, and in this, his economics conformed with his personal morality, as discussed in Chapter 18.

The triumph of Keynesian economics in modern universities is reflected in the destruction of savings and the culture around it. The western societies that experienced the Industrial Revolution and the benefits of modern capitalism, thanks to many decades of saving and capital accumulation, currently have savings rates in the low single digits, and they have been at these levels for decades. The inflationary monetary policy, which Keynesians tout as the driver of economic growth discourages people from saving, and when this inflation results in the inevitable crises discussed in the latter chapters of the book, the Keynesians blame the crises on saving, and suggest more inflation to remedy the effects of inflation.

Limits to Capital

As quantities of capital are accumulated beyond a certain point while other factors remain constant, capital marginal productivity diminishes. A textile factory that gets machines for its workers will witness very fast productivity growth with the first machine it procures. Productivity increases with each worker that moves from using his hands to using a sewing machine. However, each additional machine will have a smaller marginal benefit than the previous machines. The extra machine will be used as a backup in case any of the others break down, so its marginal contribution will be lower than the previous machine that was employed full-time. As more machines are accumulated without corresponding increases in workers and other factors of production, and without technological improvement, the marginal productivity of each unit decreases. Going from fishing by hand to using a fishing rod increases the productivity of the fisherman by more than going from one fishing rod to two.

This relationship has driven some economists to hypothesize that there are limits to capital accumulation, or that capital accumulation cannot drive economic growth in the long run. While strictly true in a world in which capital grows while other factors of production remain stationary, a cursory look at the real world around us illustrates how far this is from reality. In the real world, the accumulation of capital does not run into diminishing returns because technological knowledge is constantly advancing, thus allowing us to accumulate better capital, not just more capital. The technological advance is itself a function of increasing capital accumulation. In other words, the more capital available, the more technologies can be attempted, and the more technologies will be found. The availability of capital is the prerequisite for elongating the structure of production and introducing new technologies. Ideas for technologies are quite cheap to come by, but execution is expensive because it requires capital, which is expensive.

In the real world, a fisherman does not continue to invest in accumulating an ever-growing number of fishing rods with declining marginal productivity. Instead, he will invest in other, more productive technologies, such as a fishing net, a fishing boat, and eventually, the Annelies Ilena. While it may seem like we can have too much capital, in practice, as long as any fisherman is less productive than the Annelies Ilena, there is still a lot of room for capital to be accumulated in the fishing industry without even any innovation taking place. Even the Annelies Ilena itself cannot be viewed as the pinnacle of capital productivity in the fishing industry. There is nothing about this boat that makes it the highest level of productivity possible for fishing. A capitalist with more resources could commission the building of an even more productive boat, with an even longer production process for designing, building, and operating it. More engines could increase its speed, larger freezers could increase its holding capacity, more nets could increase its catching capacity. Should the capital and time be made available to the world’s best and most experienced boat engineers, it is extremely doubtful they would not be able to come up with a more productive boat than the Annelies Ilena. The reason we have no boat more productive than the Annelies Ilena is simply that we have not deployed more capital into the construction of fishing boats, the accumulation of which is limited by our ability to save and our time preference. It is not that we have reached the end of capital accumulation, nor that we have run out of ideas to improve the fishing boats we currently have.

The limit on capital investment is the present opportunity cost in terms of present goods. We can never run out of the high opportunity cost of capital for us to have too much capital. The reason a more productive boat than the Annelies Ilena has not been built is that potential investors value other investment opportunities or consumption more than they value taking a risk on producing these larger boats. The more capital we accumulate, the higher the productivity of our time, the more we value our time, the higher the value of leisure, and thus, the more expensive it is to sacrifice leisure for labor and capital. With time and capital accumulation, newer and better boats will be made. More advanced trawlers do not simply take away from the fish that would be caught by the fishermen with less advanced machinery. Instead, they allow fishermen to reach deeper into the sea, find the fish that would not have been caught by the other fishermen at all, bringing more fish to market, satisfying the needs of more customers.