Table of Contents

Economics is not about things and tangible material objects; it is about men, their meanings, and actions. Goods, commodities, wealth and all the other notions of conduct are not elements of nature; they are elements of human meaning and conduct. He who wants to deal with them must not look at the external world; he must search for them in the meaning of acting men.

– Ludwig von Mises

Ludwig von Mises’ magnum opus, Human Action, offered an explicit redefinition of the field of economics as the study of human action and choice under scarcity. Mises believed proper economic reasoning and analysis of economic phenomena must be based on analyzing human action, rather than analyzing material objects and their properties, or analyzing aggregate and abstract units. While Mises’ perspective might initially seem pedantic and unproductive, this chapter will explain how it is a very powerful tool for understanding economic reality.

Mises argues that philosophers had long attempted to analyze humanity’s evolution and destiny based on an understanding of what history, God, or nature had intended for humans. Such analyses dealt with humanity as a whole or analyzed collectivist concepts like nation, race, or church, and sought to find laws to explain the behavior of such entities and their consequences, as if history had ironclad laws to be discovered, akin to the natural sciences.

In writing Principles of Economics in 1871, Carl Menger pioneered marginal analysis of economic questions. This “marginal revolution” provided a starkly different alternative to the previous methods of analyzing humans. Rather than analyzing history based on the will of God, nature, or through nation, race, or church, marginal analysis showed that human society is better understood by analyzing its prime driving forces: individual human choice and action. The Austrian school of economics emerged around Menger in Vienna. A few years after him, Léon Walras would develop his own conception of marginalism couched in a concept of general equilibrium. The Walrasian general equilibrium would become the dominant tradition in modern economics, relying on mathematization and relationships between aggregates.

Action, purpose, and reason

Mises defines human action as “purposeful behavior,” so as to distinguish it from instinctive, impulsive, or emotional acts. “Action is will put into operation and transformed into an agency, is aiming at ends and goals, is the ego’s meaningful response to stimuli and to the conditions of its environment, is a person’s conscious adjustment to the state of the universe that determines his life.”

Mises’ student, Murray Rothbard, defines human action as “purposeful behavior toward the attainment of ends in some future period which will involve the fulfillment of wants otherwise remaining unsatisfied.” Mises posits that for action to take place, it requires a human to have a current state, to imagine a more satisfactory state, and the expectation that purposeful behavior can alleviate uneasiness.

Rational action is a quintessentially human quality that distinguishes humans from other animals. Humans act purposefully because we are endowed with reason and are able to direct it to the meeting of our ends. Humans are capable of recognizing causal relations in the world around us, and acting upon this understanding to bring about a more favorable state of affairs. We are also able to understand that others have reason and are able to act to their end. As Mises puts it:

Man is not a being who cannot help yielding to the impulse that most urgently asks for satisfaction. Man is a being capable of subduing his instincts, emotions, and impulses; he can rationalize his behavior. He renounces the satisfaction of a burning impulse in order to satisfy other desires. He is not a puppet of his appetites. A man does not ravish every female that stirs his senses; he does not devour every piece of food that entices him; he does not knock down every fellow he would like to kill. He arranges his wishes and desires into a scale, he chooses; in short, he acts. What distinguishes man from beasts is precisely that he adjusts his behavior deliberatively. Man is the being that has inhibitions, that can master his impulses and desires, that has the power to suppress instinctive desires and impulses.

A useful mental image to explain the primacy of human action is to think of the physical world around us as inert playdough we can mold with our hands into different shapes and objects based on our reasoning and imagination. Inanimate objects are dead matter, and it is human reason shaping human actions that rearranges this matter and gives it value, meaning, and purpose. One understands the material world far better if one studies it as the product of human reason and action. Attempts to explain social phenomena through reference to physical objects, abstract nouns, or collectivist entities are ultimately futile and decidedly inferior to thinking in terms of human choice and action. It is not the stars, nor abstract nouns and entities that act, but individuals. If you want to understand the conditions of the material world, it is most useful to study the actions of the humans who mold it.

In the Misesean and Austrian tradition, human action is understood and defined as being rational. The word “rational” in this context does not refer to the correctness of the action according to some objective criteria, nor does it refer to the suitability of the action in achieving the ends of the acting man, nor does it pass other moral judgments on the action. Rather, rational here is defined as the product of deliberative reason. Whenever man reasons and acts, he acts rationally. Whether such an action is conducive to achieving his goal or not, and whether such an action meets the approval of another party assessing it are irrelevant to “rationality” as understood and defined by Mises. A person may regret an action and realize it was counterproductive to achieving his ends, but that does not change the rationality of the act, in the sense that it was the product of deliberative reason, correct or faulty. Other individuals may pass judgment on this individual’s actions. No matter how wrong they find it, that would also not detract from the rational nature of the act. The Austrian conception of rationality becomes clearer with Mises’ explanation that “the opposite of action is not irrational behavior, but a reactive response to stimuli on the part of the bodily organs and instincts which cannot be controlled by the volition of the person concerned.” Further, “An action unsuited to the end sought falls short of expectation. It is contrary to purpose, but it is rational, i.e., the outcome of a reasonable—although faulty—deliberation and an attempt—although an ineffectual attempt—to attain a definite goal.”

Economic Analysis

Thinking of economics as the study of human action under scarcity allows us to define the most important terms in economics based on their relation to human needs, how human reason treats them, and how humans shape them.

When explained, defined, and understood through the lens of human action, economic terminology becomes clearer and economic analysis more fruitful.

Hans-Hermann Hoppe explains:

All true economic theorems consist of (a) an understanding of the meaning of action, (b) a situation or situational change – assumed to be given or identified as being given – and described in terms of action – categories, and (c) a logical deduction of the consequences – again in terms of such categories – which are to result for an actor from this situation or situational change.

At the heart of the Austrian approach to economics is the goal of understanding the causal processes of economic activity and their consequences. Logical deduction, thought experiments, and common sense familiarity with reality are employed to understand the implications of economic processes. Initially, this approach might appear banal and fruitless compared to the dominant approaches of mainstream economics today, which rely on mathematical analysis. But a closer look shows us why quantitative analysis is unsuited for building an economic theoretical framework. It will also show us why quantitative analysis is meaningless and mute without logical deduction and conclusions to motivate it and understand its results. In keeping with the Austrian critique of quantitative approaches to economic analysis, this book will present and analyze economic acts in plain language, not with mathematical equations. Human action will be understood through logical deduction and thought experiments, not equations and quantitative analysis.

Quantitative Analysis

The Austrian critique of quantitative analysis was summed up in Mises’ critique of the application of quantitative methods to economics in Human Action:

The fundamental deficiency implied in every quantitative approach to economic problems consists in the neglect of the fact that there are no constant relations between what are called economic dimensions. There is neither constancy nor continuity in the valuations and in the formation of exchange ratios between various commodities. Every new datum brings about a reshuffling of the whole price structure. Understanding, by trying to grasp what is going on in the minds of the men concerned, can approach the problem of forecasting future conditions. We may call its methods unsatisfactory and the positivists may arrogantly scorn it. But such arbitrary judgments must not and cannot obscure the fact that understanding is the only appropriate method of dealing with the uncertainty of future conditions.

This is a profound criticism of the methods of modern economics. As discussed in detail in Appendix 1, there is no standard unit with which economic measurements of value can be made and compared. As discussed in Chapter 2, value is subjective. The utility that individuals get from goods is also subjective and constantly changing based on the individual, the time at which they are making their valuation, and the relative abundance of the good. There is no possibility for aggregated interpersonal utility comparison, and therefore the mathematization of utility will always be hypothetical and theoretical and never precise and replicable.

Without a common unit with which to measure and compare utility, it is impossible to formulate a quantitative law around, for example, changes in demand and supply based on changes in price, such as a law positing that a 1% increase in price corresponds to a certain percentage decrease in quantity demanded. The impact of a specific change in price on an individual’s demand for a good happens through the causal mechanism of changes in individually assessed utility. That factor is not measurable or quantifiable.

Replicable experimentation on economic questions is also impossible. The objects of study of the natural sciences are the structure and behavior of the physical world. It is assumed at the outset that these are regular, that their properties can be isolated and observed by repeatable experimentation, and that they can be appropriately and fully modeled with mathematics. It is fundamental to the intellectual enterprise that the sole and entire purpose of this methodology is to rigorously pin down causation. In the physical world, what causes what else? Why do things happen exactly and only the way they do? But the objects of study of the social sciences are the ideas and actions of humans, which are immeasurable and non-quantifiable. Experimentation with ill-defined units of irregular phenomena cannot yield comparable and reproducible results, and so experimentation will fail to produce quantitative laws because there are no units in which these laws can be expressed. Without measurement and repeatable experimentation, it is not possible to find regularities, derive constants, and formulate mathematical relationships and scientific laws. Accurate experiments in economics are also not possible because the subject of economics is the action of humans in the real world, and conditions in testing laboratories cannot replicate the real-world consequences of economic decisions. The real world is the only laboratory that can approximate the real conditions shaping economic decision-making, but it is impossible to experiment on the real world using scientific methods such as those employed in the natural sciences.

Beyond the issues of measurement and experimentation, a deeper logical problem with quantitative approaches to economics is that they conflate the factors we can measure with the causative factors that shape the world around us. The quantitative methods which establish relationships between aggregate measures place the aggregates as the driving causal forces for no reason more well founded or coherent than the fact that they can be measured. Whereas in the natural sciences, regularities and constants are discovered through repeated open experimentation, empirical economists simply make the assumption that their data is regular and deduce laws based on it. In the natural sciences, the complexity of the atoms that make up a gas, for example, can be reduced to basic aggregate measures of pressure, temperature, and volume without any loss in analytical accuracy. The atoms have no will of their own, they have no mind, they cannot reason, and they cannot act in response to surrounding conditions, like human beings can. Because they lack reason, the behavior of physical objects can be studied and accurately predicted.

When examining economic questions, however, we are confronted with the reality that human beings and their actions are the causative factors shaping economic reality, motivated by their subjective considerations and personal preferences. Far from being inanimate objects reacting in mathematically predictable ways, humans react in irreducibly complex ways. Attempting to paper over the complexity of the actions of millions of humans by examining only superficial aggregate measures of some economic phenomenon is the core mistake of failed modern pseudosciences like macroeconomics and epidemiology. These fields ignore the actual causative factors of the phenomena they study and instead attempt to hypothesize based on whatever aggregates can be measured. As Hayek explains:

Unlike the position that exists in the physical sciences, in economics and other disciplines that deal with essentially complex phenomena, the aspects of the events to be accounted for about which we can get quantitative data are necessarily limited and may not include the important ones. While in the physical sciences it is generally assumed, probably with good reason, that any important factor which determines the observed events will itself be directly observable and measurable, in the study of such complex phenomena as the market, which depend on the actions of many individuals, all the circumstances which will determine the outcome of a process, for reasons which I shall explain later, will hardly ever be fully known or measurable. And while in the physical sciences the investigator will be able to measure what, on the basis of a prima facie theory, he thinks important, in the social sciences often that is treated as important which happens to be accessible to measurement. This is sometimes carried to the point where it is demanded that our theories must be formulated in such terms that they refer only to measurable magnitudes.

Just because we are able to construct measures of unemployment, gross domestic production, consumption, investment, and other economic quantities does not mean that these factors are causally related to one another in scientifically preordained relationships based on quantifiable and testable magnitudes. In fact, since the actual drivers of these measures are the actions of individuals, there is no reason to suppose that they are any more than superficial epiphenomena unrelated to the causal mechanisms driving the relationships examined.

Attempting to formulate meaning from the relationships between these aggregates is akin to scientists studying gases and attempting to formulate laws based on the color of different containers, the number of containers used, the brand of the manufacturer, the first letter in the name of the experimenter, and various epiphenomena with no causative effect on the experiment. A scientist can indeed formulate relationships between these (irrelevant) parameters, but it will be impossible for any such relationship to hold after repeated testing by independent parties because they have no connection to the causal process being studied. Repeating the same experiment with an experimenter with a different name or a container of a different color will still yield the same results, making the original experimenter’s theorizing pointless. It is the inanimate gas particles whose temperature, pressure, and volume are the control knobs for the system being studied; the container’s color and experimenter’s name are irrelevant. Similarly, it is the action of humans that shapes economic outcomes, not the aggregate measures constructed in government statistics offices.

This is not to say that all statistical measures are worthless noise, as one can find subjective value when examining these aggregates as close approximations of economic phenomena. The Austrian objection is not to economic statistics per se, but to attempting to build scientific-seeming theories out of statistical aggregates. The most egregious and harmful attempts to ape the methodology of the natural sciences in economics happen in macroeconomics. The physics envy of macroeconomists has, for a century, fueled the search for a system of equations that can explain the dynamics of an economy in the same way equations can explain and predict the movement of objects. Friedrich von Hayek calls this “scientism”: the slavish imitation of the method and language of science where it is inapplicable. The hope is that, with an accurate scientific system of equations for understanding the working process of an economy, it would become possible to manage economic activity to achieve desirable goals. In the same way that chemists’ equations have helped engineers perfect and optimize the working of engines and pumps, scientism searches for economic equations that can help economists improve the state of “an economy.”

In macroeconomics, aggregates are constructed from national accounts, and mathematical relationships are sought between them. Such relationships are established theoretically, based on some economist’s authority to declare how the causal mechanisms function, not on experimentation. English economist John Maynard Keynes’ macroeconomic system is the most prominent example. For decades, economists have formulated equations based on Keynes’ theoretical hypothesizing. The state of the economy is primarily a reflection of the amount of spending. If spending is too high compared to output, then inflation and growth are the outcome, but if spending is too low compared to the output, then unemployment and recession are the outcome. Should unemployment be too high, modern macroeconomic equations suggest this can be fixed by increasing aggregate spending through increased government spending or expansionary credit policies. High inflation, on the other hand, can be fixed by reducing aggregate spending through increased taxes or contractionary credit policies.

But accounting identities do not denote real-world causality. There are no mechanisms in macroeconomics to experimentally establish causality as is possible in the natural sciences. Keynes’ equations attempting to predict the impact of one aggregate metric on another bear no relation to real-world cause and effect, because there is no way of measuring, testing, and verifying any of it.

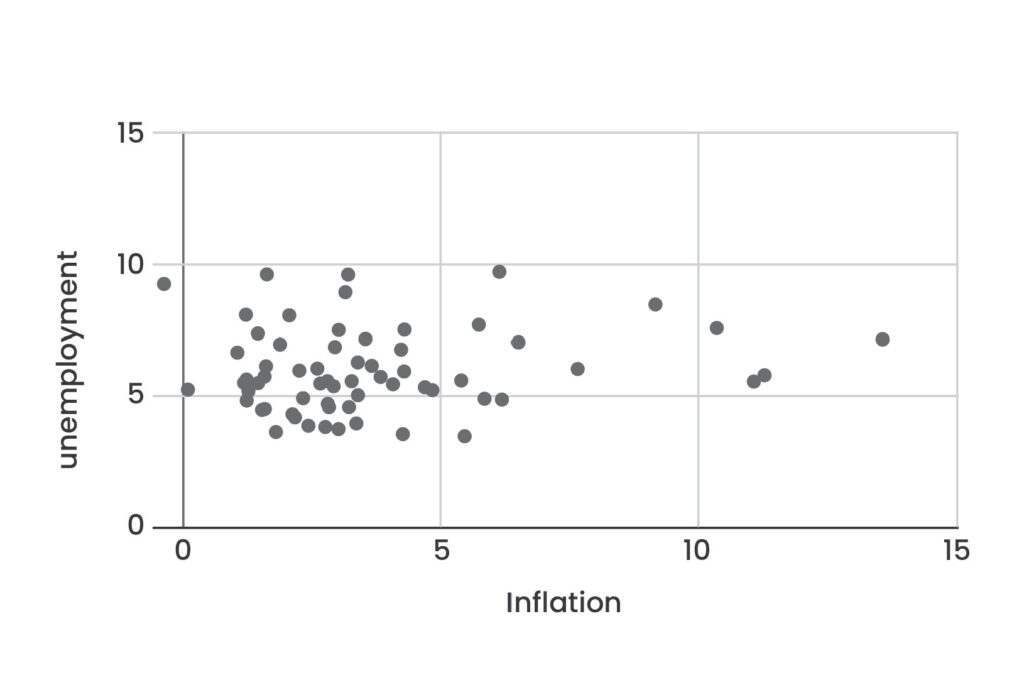

No studies can test Keynes’ hypothesis, because one cannot experiment on entire economies comprising millions of people who have individual life plans. Nor can one run a suitable control on those same people under different circumstances. But even by observing government statistics collected by adherents of the theory, real-world experience has contradicted the theory for decades. The Keynesian system necessarily implies a trade-off between the unemployment rate and the inflation rate, a relationship termed the Phillips curve, which is supposed to be a downward-sloping curve to illustrate the trade-off. But real-world experience does not show this, as Figure 1, with data from sixty years of U.S. government statistics, shows no such trade-off.

However, this theory persists to this day, in spite of decades of accumulated evidence that it is not an accurate explanation of how the world works. In the 1970s, as inflation and unemployment both increased at the same time worldwide, the Keynesian trade-off was comprehensively refuted beyond a shadow of a doubt. But the advantage of economics having no systematic and replicable method of experimentation and testing is that theories can always be adjusted after their failure in a way that can justify non-compliant real-world observations. That is the essence of pseudoscience.

Hilariously, Keynesians simply revised their theory to include a new term, “supply shock.” Supply shock is an incoherent term, made as an after-the-fact justification to explain how increases in unemployment and inflation can happen simultaneously. Since then, the world’s economies have witnessed every imaginable combination of inflation and unemployment rates, and the Keynesians have successfully maintained the delusion that such a trade-off between unemployment and inflation exists. Any diversion away from this relationship can be explained by invoking a supply shock or various other thought substitutes, and so there can be no observation that falsifies it. It explains everything and therefore explains nothing. The illusion of economics as a precise, quantitative, and empirical science is only maintained through the exemption of its theories from empirical real-world examination.

After a century of aping physics and abandoning classical methodological foundations, economics has failed to produce one quantitative law or formula that can be independently tested and replicated. Macroeconomic equations come and go with the fashions of modern schools of thought, but none of them has been measured objectively and replicated in a way that can allow it to be called a scientific law. That macroeconomics empowers central governments and enriches academics may help explain why it has endured.

A contrast of approaches

To illustrate the human action approach to economics, and to compare it with modern quantitative economic methodology, we can use as an example the question of government-mandated minimum wages, which impose a lower limit on what employers can pay their employees. A popular policy intervention in the majority of the world, the two opposing perspectives on it serve as an object lesson in the two different frameworks for thinking about economics: human action and aggregates.

Imagine a politician looking to win an election in a country with no minimum wage laws. As in all times and places in human history, there is a natural variation in the wages earned by workers. The politician decides to center her campaign around improving the living standards of the poorest members of society by mandating a minimum wage, which she imagines guarantees its recipients a decent living. Based on her aggregate-focused macroeconomic framework, the aspiring leader decides to mandate a minimum wage of $10 per hour. The economist concludes that 20% of all workers, supporting 35% of all the population, currently earn less than $10 per hour. The aggregate effect of imposing the minimum wage would lead to a rise in wages equal to $10 billion per year. Based on sophisticated historical and theoretical models, the fiat economist further estimates that the $10 billion increase in payrolls would translate to an $8 billion increase in consumer spending, which models estimate would result in the creation of 40,000 new jobs, a 12% increase in industrial output, a 4% rise in exports, and a $16 billion increase in gross domestic product.

According to this collectivist approach to economic analysis, the aggregates are the causal agents in economic phenomena, and they act according to the theoretical relationships established by fiat economists, in a similar way to how physicists and chemists establish scientific rules. These conclusions were arrived at using scientific-looking equations not very different from those used in the ideal gas law. Using the framework of aggregate economic analysis, the minimum wage law sounds like a great boon to society. The poorest workers will increase their living standards significantly, some unemployed workers will find work as a result of the extra spending, and all of society becomes more productive. What is more, exports rise, helping the economy obtain foreign currency.

If this sounds too good to be true, that is because it is not true. Things look different through the lens of the sound economist’s Mises-tinted glasses. Knowing that human action is the real driver of human affairs, the sound economist does not analyze the world through aggregate quantities. Instead, he analyzes the decisions of the real humans affected by this new law. Employment is an agreement between two individuals, the employer and the employee. The sound economist understands that a business owner’s choice to hire someone is based on a simple calculus: She will hire him if his contribution to the firm’s revenue exceeds his wage. If the minimum legal wage exceeds the marginal revenue he brings, then hiring him costs the business money and is akin to a donation from the business to the worker. Employers know that making such a hire is a costly mistake, and employers who do not know that will soon witness their business fail as it continues to hemorrhage money on wages it cannot afford. Only employers who understand this economic reality will remain employers, and those who do not will lose their businesses. Emotional blackmail by politicians can change nothing about this reality.

Wages, like all prices in a market, are not just arbitrary numbers chosen by greedy employers. They are a reflection of the marginal productivity of the worker. As the law now stipulates that a worker must be paid $10 per hour, the

employer now has to reconsider whether it is worth hiring this worker. When the government mandates a minimum wage, it does not magically alter the calculus of the employer, nor does it magically increase the worker’s productivity. The employer will still only hire workers whose productivity is higher than their wage. Thus, the minimum wage law makes it illegal for employers to hire anyone whose marginal productivity is less than $10 per hour. Any worker whose productivity is less than that will now become a drain on any business that hires him and pays him that amount. Either he gets fired, or the business that hires him loses money and goes bankrupt. In all cases, these jobs are eliminated, and everyone whose productivity is less than $10 per hour is now legally unemployable; either unemployed or employed illegally.

Viewed through the lens of human action, the effect of a minimum wage law is to make it illegal for workers with low productivity to get jobs, and many of these workers will lose their jobs. Continuing to look through the lens of human action, one would find that the workers who lose their jobs are those with the lowest productivity in society, and these are usually the poorest, youngest, and least experienced workers. Making it illegal for them to work is effectively making it illegal for them to raise their productivity by learning on the job and acquiring valuable on-site work experience. Minimum wage laws are thus particularly pernicious to the people who need to work the most, and they are a causal factor in the emergence of wide-scale unemployment, as well as unemployability. Another possible implication is that some businesses, particularly those that depend on these low-wage laborers for their operation, would pay higher wages but also raise the prices of their goods to finance the higher wages. Consumers would then pay the price through higher prices and lower quantities of goods available. In this scenario, any potential increase in a low-wage worker’s income would be counteracted by a corresponding increase in the cost of the goods he must consume.

All these consequences of minimum wage laws are deducible by sound economists who analyze the wage law and evaluate the implications it will have on rationally acting individuals. This turns out to be a far more useful and accurate assessment of the situation than anything that can be conjured from examining mathematical metrics. Prices are a reflection of underlying market reality driven by human action. Attempting to alter the underlying market reality by altering its reflection is unworkable. Every attempt at passing price controls has backfired because this kind of central planning ignores the role of human action. Price controls treat economics as if it were about material objects, rather than human action. Schuettinger and Butler have written a depressingly entertaining history of price controls in Forty Centuries of Price Controls, illustrating how this exact dynamic has repeated itself across cultures and nations throughout history. The kings, emperors, politicians, and bureaucrats look at the world of economic transactions as an inhuman process they can alter to suit their needs. They mandate that the observable epiphenomena associated with markets fall within acceptable ranges. They assume humans will just adjust their actions to ensure these laws are upheld. However, in reality, humans adjust their actions to optimize for their own well-being, not to satisfy bureaucrats. The merchant would rather not sell at all than sell at a loss. You will either see the free-market price or you will see no market price at all. In the latter economy, real prices are expressed in underground markets.

Actual economists understand that observable economic phenomena and metrics are but manifestations of the underlying actions of the humans involved. Humans are constantly seeking to improve their own situation in life, and it is futile to mandate that they act against their interests. Mandating laws against humans’ self-interested nature does not change human nature; it reduces the incentive to behave legally and so destroys society’s respect for laws. This essential realization is why the sound economist is in favor of individual economic freedom and against its restriction by governments. The human spirit is indomitable, and it will not act in a way that is harmful to itself.

The sound economist understands humans are constantly acting to improve their lot in life. Imposing legal punishments on any peaceful economic activity they might choose cannot lead to an improvement in their lives, as it will simply restrict and reduce the choice of actions available to them.

Aggregate analysis blinds the fiat economist to the implications of these laws for the humans whose freedoms it restricts. After formulating mathematical measures of social phenomena, the collectivist economist then assumes that these measures are causal factors in the determination of human affairs.

The world already has far too many economics textbooks written in the pseudoscientific quantitative tradition. This book will definitely not be one of them. It will not try to explain economics in the language of the natural sciences, and it will contain no sophisticated aggregate equations. Such approaches promise much but deliver little in terms of reliable, useful, and actionable insights.