Table of Contents

With the analysis of the previous three chapters, it is now possible to discuss the true costs and benefits of a bitcoin monetary system and how they compare with the fiat monetary system discussed in Chapter 12. As always in matters of human action, theoretical debate cannot substitute for, or overrule, the outcomes emerging from human action. Engineers, economists, and politicians may have strong opinions about what is a useful or wasteful monetary system, but the only actual answer that matters is the one that humans offer with their actions, in the goods they consume and produce in response to the market reality offered by these technologies. Intellectual arguments are very cheap, but actions are very costly.

Should people find no value in the bitcoin network, they would not be paying for its continued operation. The proper professional response of an economist, in this case, is to analyze where the value lies for the users. It is not to throw hissy fits declaring the network is worthless because they cannot see the usefulness, as has been the reaction of most fiat economists. Rather than take the well-worn path of dismissing the network’s value based on fiat textbook theories, this chapter attempts to explain why a growing number of users find value in bitcoin by examining the costs and benefits associated with upgrading from fiat to bitcoin. From the perspective of fiat academics, reality is wrong by not agreeing with the government-sponsored theories in their textbook. But a simpler and more logical explanation is that bitcoin’s fast rise is the return of a free market to money, and we are witnessing a superior-good rise at the expense of an inferior good.

Bitcoin Costs

1) Electricity cost

The amount of energy that Bitcoin consumes can theoretically be estimated from its hashrate, or direct output of the energy consumption of the machines that secure the network. The machines that mine bitcoin have known specifications in terms of how much electricity they consume, and how many hashes they can produce. The bitcoin hashrate can be estimated from the difficulty and the block time. The hashrate and some reasonable assumptions of the composition of bitcoin mining equipment can give us a good idea of how much electricity is used by the bitcoin network at any point in time. Current best estimates put bitcoin’s energy consumption somewhere in the range of 100-150 TWh/year. This is an enormous amount of energy, and the fact that it is deployed voluntarily is a testament to the amount of value people place on the network and its assets.

As discussed in the last chapter, most of this energy would otherwise have been wasted. It is almost always electricity that is quite cheap by international standards, probably in the range of two to five cents per kWh. At that cost, and at its current hashrate, bitcoin is consuming around two to six billion U.S. dollars worth of electricity every year, most of which would be wasted otherwise. By being able to buy electricity anywhere, and by allowing only the most profitable miners to survive, bitcoin only buys the cheapest electricity and does not compete for the expensive sources of electricity in high demand.

2) Overall security cost

Bitcoin mining is a very competitive industry. The costs incurred by miners on hardware and electricity to secure bitcoin will be roughly in the range of the rewards they are able to collect from the network. The cost of securing bitcoin can be approximated to be equal to the aggregate miners’ reward, which is the total sum of bitcoin received by miners in bitcoin block rewards, containing the block subsidy (new coins) as well as transaction fees.

The daily mining reward is precisely ascertainable from the bitcoin client. When combined with the daily average price, it can give us the dollar market value of daily rewards received by miners throughout bitcoin’s existence. At the time of writing, bitcoin is trading at around $43,000 while the daily mining reward is running around 1,000 bitcoins per day, giving a security expenditure of $43 million daily. When examining bitcoin’s entire lifetime until the end of July 2021, we find that it has consumed $29.42 billion in security expenditure. This can be considered a reasonable estimate of the total expenditure of miners for operating the bitcoin network.

Bitcoin Benefits

Secure savings

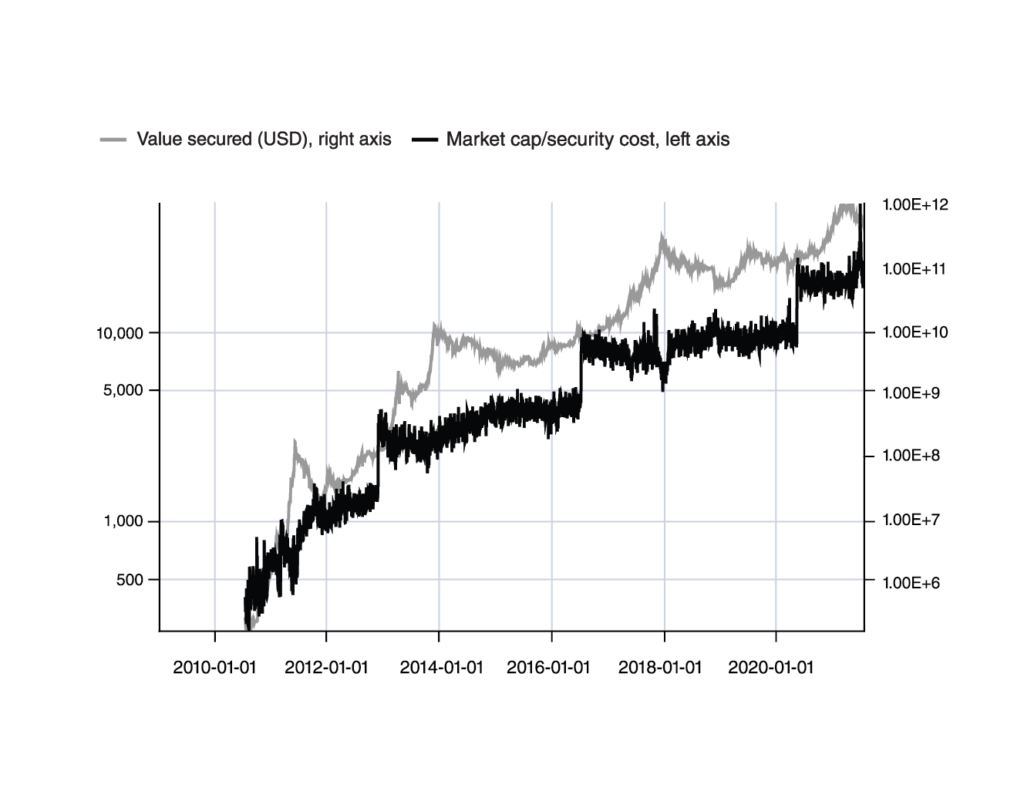

We can understand bitcoin as an electricity-based technology for saving economic value. It takes electricity and hardware as an input and produces savings protected from inflation and fraudulent manipulation. We can measure its efficiency as a savings mechanism by measuring the value stored in it compared to the value spent on securing it. The economic value stored in bitcoin can be approximated by the market value of the total supply of bitcoin, since anyone holding bitcoin at that price is indicating that they value it more than they value holding its value in other currencies or assets, or consuming its value by purchasing the consumer goods it can secure. The cost of securing bitcoin is equal to the miners’ rewards.

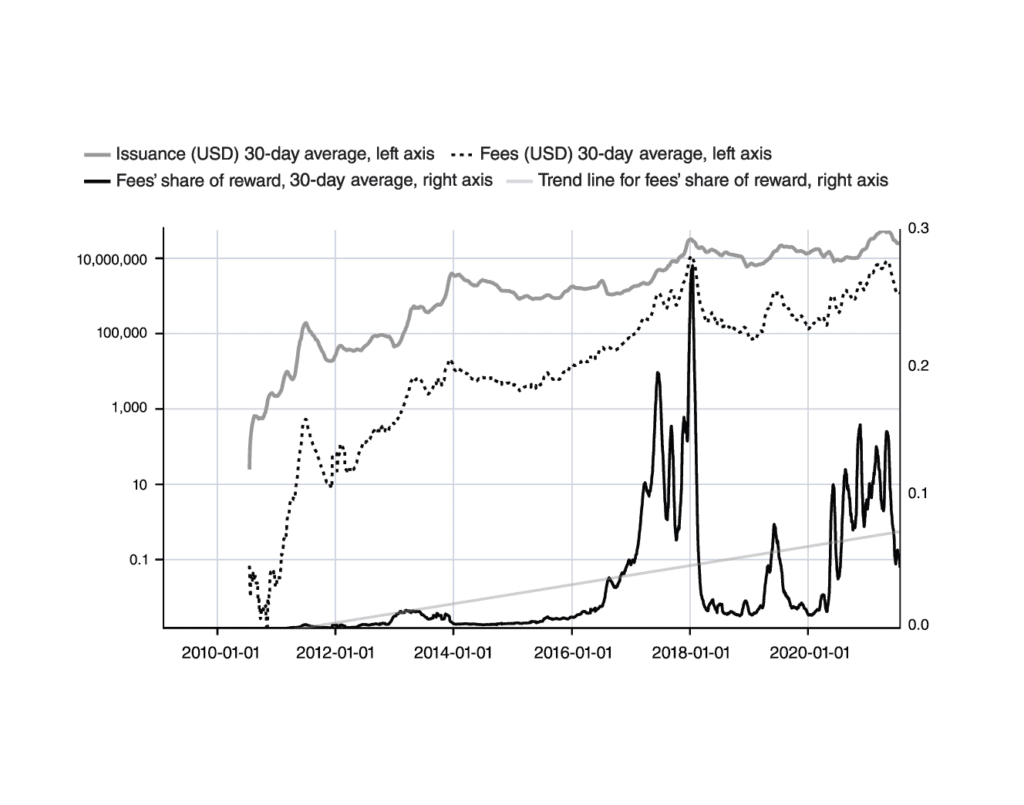

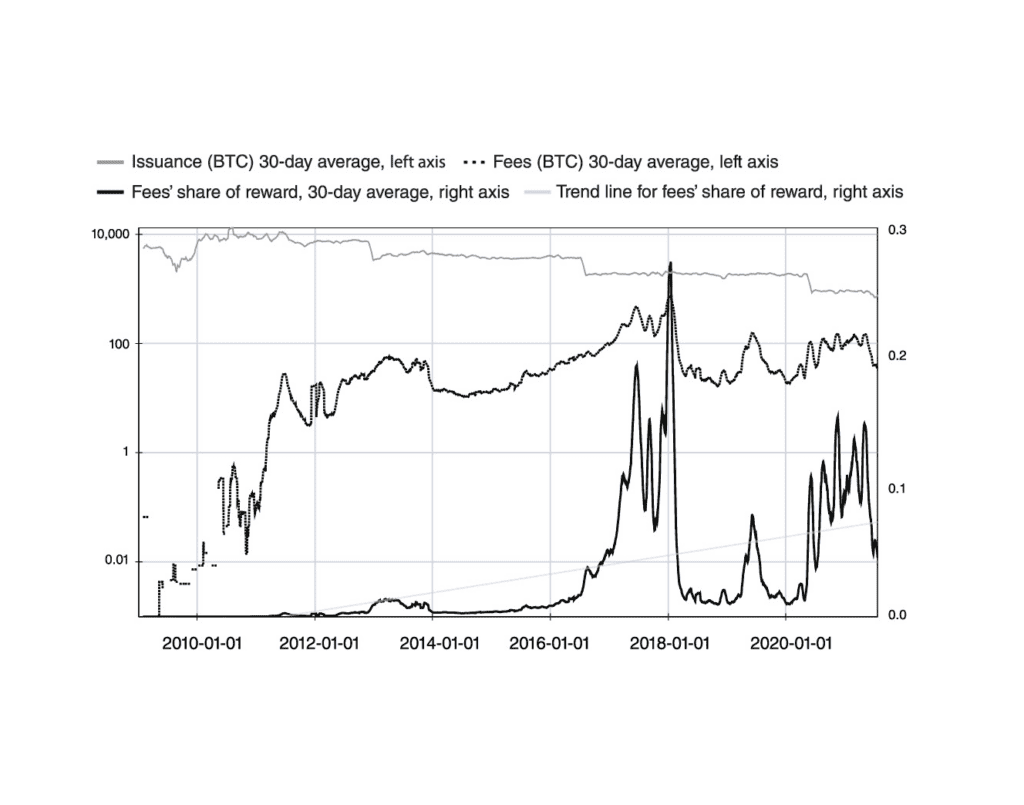

The mining reward consists of the transaction fees paid by users, as well as the block subsidy, which contains the new coins created with each block. So far, transaction fees have been lower than 5% of total block reward for the majority of bitcoin’s existence, which means that the total block reward has been very similar to the block subsidy. If we consider the operational efficiency to be measured as market cap over mining reward, and reward approximates subsidy, then it is a number very close to the percentage growth rate of the bitcoin supply, or the inverse of the stock-to-flow ratio. This brings us back full circle to the discussion of stock-to-flow at the beginning of The Bitcoin Standard, where I argue the stock-to-flow ratio is an extremely important metric for determining monetary status. Goods with a low stock-to-flow ratio will witness a large increase in their liquid stockpiles as a result of any rises in price, but goods with a high stock-to-flow ratio will only witness small increases to their existing liquid stockpiles. Calculating bitcoin’s operational efficiency as a savings vehicle reveals that it is very close to stock-to-flow, and that is an engineering explanation of the nature of the role of money. Money is as efficient as it resists debasement, and the better it is at resisting debasement, the more value will accrue to it. As bitcoin’s supply growth rate has declined, its operational efficiency has increased, and the amount of value it has attracted has increased.

Up until this point in bitcoin’s existence, the mining reward has been very close in value to the block subsidy, but as the block subsidy declines, transaction fees will necessarily become a larger fraction of the total block reward, and the operational efficiency of bitcoin will diverge from the stock-to-flow ratio, and converge toward the ratio of transaction fees to total market capitalization. It will be fascinating to watch what happens to the ratio of transaction fees to total market capitalization as the block subsidy goes to zero, and whether it stabilizes at a specific level.

Appreciating savings

Another way of thinking of bitcoin’s efficiency is to consider how efficient it has been as a savings technology for those who have utilized it. We can estimate that based on the ratio between the total current market value of all bitcoins over the value that was invested in producing these coins. We can approximate the sum of dollars spent on bitcoin as being the sum of the dollar value of daily bitcoin production over bitcoin’s existence. On any given day, new bitcoin are being produced and sold on the market at the predominant market price. This is the case even if the miner who mines the coins does not sell them, as they are effectively buying them at the market price and holding them. At any given bitcoin price, the production of new coins increases the amount of value that needs to be held in bitcoin cash balances in order for the price to stay constant, and that increase is equal to the bitcoin price multiplied by the the number of bitcoin mined on that day. Whether through bitcoiners holding a larger market value of bitcoin balances, or through new buyers buying new bitcoin, each day witnesses increased new expenditure that is approximately equal to the market value of new coins produced.

Summing the daily dollar value of market rewards results in a sum of $27.33 billion spent over the previous twelve and a half years, at a time when bitcoin’s market capitalization is in the range of $0.62 trillion. This is roughly a 2,200% average return on investment. Effectively, the bitcoin network’s native tokens have appreciated an average of twenty-three times their original value since their creation. As a mechanism for saving wealth into the future, bitcoin’s efficiency is off the charts. As a superior technology for saving, bitcoin is attracting a growing amount of wealth, and bitcoin’s reliable scarcity causes preexisting holders’ bitcoins to appreciate.

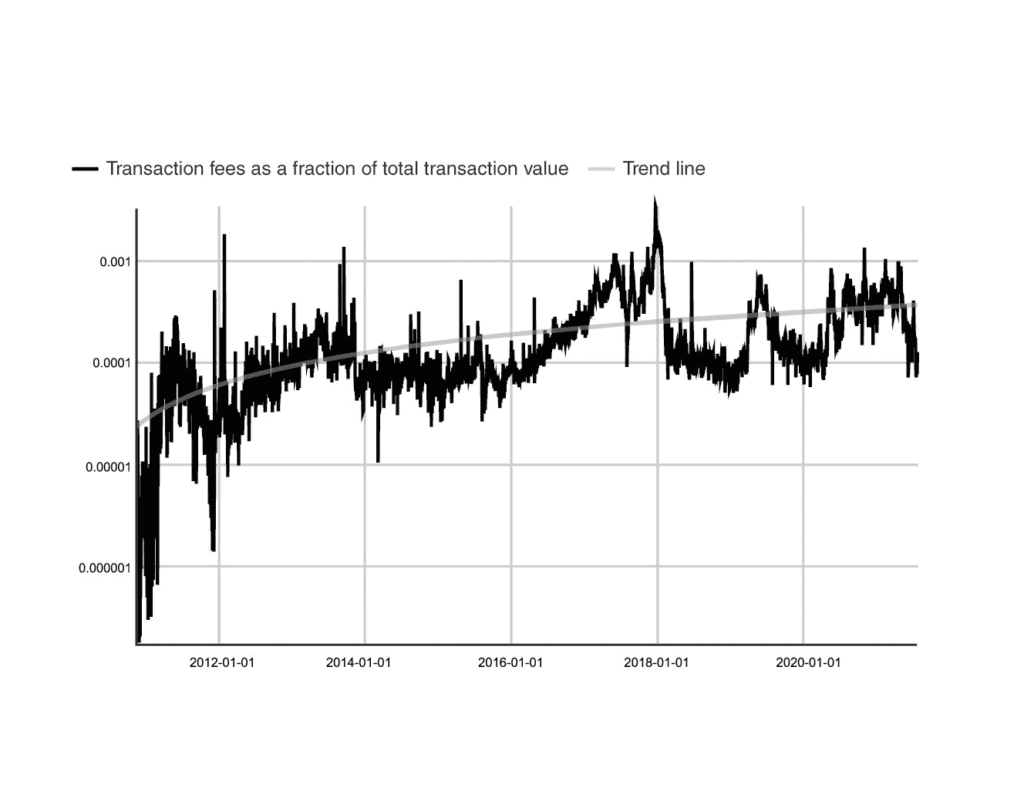

Global Money Transfer

Bitcoin does not just secure savings, it can also move economic value around the world. Estimating bitcoin’s efficiency as a mechanism for transferring value can be done by measuring the ratio of transaction values to the fees paid to transfer them. For the period between October 2010 and July 2021, the average daily transaction fees came up to around 0.02% of the value of the transactions. For the vast majority of bitcoin’s life, the transaction fees paid were less than 0.05% of the value of transactions. There is a clear uptrend in transaction fees as a percentage of transaction values coinciding with the decline in the daily mining subsidy of new bitcoins.

This trend is likely to continue as bitcoin’s new supply subsidy increases. That people subjectively value bitcoin creates demand for holding it and transacting with it. The bitcoin asset cannot be owned outside of transactions confirmed in bitcoin blocks, which inevitably creates a market for this scarce block space. Bitcoin’s difficulty adjustment algorithm ensures the scarcity of this block space (and thus the bitcoin token itself ) by raising the hash power, and thus the cost, required to produce these blocks. The cost to produce bitcoin blocks is merely a reflection of the market’s valuation of bitcoin, which is ultimately the subjective value people place on it when transacting with it on the market for other monies or goods and services.

A market value for bitcoin block space creates an economic incentive for miners to provide this block space securely. In all markets, demand incentivizes entrepreneurs to find the most effective ways to provide the goods that people want. The costs and the methods of payment can differ widely, but if the demand exists, the goods will be supplied. Consequently, if there is demand for holding bitcoin, then demand will also exist for transacting in it, and people will pay the necessary transaction fees to get their transactions into blocks. There is no conceivable scenario in which demand for bitcoin is high enough to necessitate massive security expenditure while demand for block space is nonexistent. If demand for bitcoin exists, demand for moving bitcoin will have to exist, and transaction fees will go up.

As it stands, each bitcoin block contains, on average, around 1 MB of data, but it carries an economic reward worth approximately $250,000 dollars. This is a cost that is ultimately borne by the users of the network, whether through inflation or transaction fees. Even if they do not recognize this, the roughly 900 new coins currently entering the market every day devalue existing bitcoins in order to subsidize miners. As this inflationary block subsidy diminishes, the payment incentivizing miners will need to come from transaction fees for the blocks to clear. There is no fixed security fee that needs to be paid to make bitcoin operate; the mining needs to be expensive enough to allow spending to happen securely without double-spends and long reorg attacks. Should such attacks become a problem for bitcoin users, this will incentivize them to pay transaction fees so their transactions get confirmed, and fees will rise. The incentive structure around bitcoin ensures that miners and users can easily find a transaction fee that finances the network’s security. The economic incentives of bitcoin have proven resilient enough to motivate people to spend the resources needed to keep the network secure. If bitcoin dies, it will not have died because of misaligned economic incentives (high transaction fees). It will have died because the demand for it declined.

We already have evidence that strongly suggests bitcoin users will be happy to pay higher transaction fees. In December 2017, fees rose to around fifty dollars per transaction. This suggests that if people want to hold hard money, the transaction fee has a lot of room to grow. If we look at the exchange fees people usually pay to buy bitcoin, we find that they are usually much larger than on-chain transaction fees. Bitcoiners still have no problem paying these extra fees, so it is hard to imagine them giving up on bitcoin because on-chain fees have increased. Premiums for buying bitcoin in places where exchanges do not operate are even higher, and it is not uncommon for buyers on LocalBitcoins, a peer-to-peer bitcoin purchasing service, to demand and get a 10% markup.

If demand for bitcoin declines or disappears, then the price will likely crash and bitcoin will collapse and/or be attacked, regardless of whether the miners are being paid in inflation or transaction fees. But if bitcoin continues to appreciate for the next twenty years, even at a rate no more than one tenth of its historical growth over the past ten years, it will become a global settlement network valued at tens of trillions in today’s dollars. Would people not be willing to pay for the daily settlement of the equivalent of trillions of modern dollars of transactions globally?

The best way to gauge the willingness to pay for these fees is to look at international settlement costs today. As bitcoin’s value, salability, and liquidity increase, more valuable transactions can be done on the network. The only real alternative to a bitcoin payment, as a form of hard cash whose value is not a government’s liability, is the settlement of gold cash reserves, which is a hugely expensive process. When compared with international gold transaction fees, which come up to around 1% of transaction value, bitcoin transaction fees at around 0.02% of transaction face value are still a rounding error. Given the unique service bitcoin provides, there is enormous scope for growth in transaction fees on top of the bitcoin network. Should the network and liquidity continue to grow, transaction fees will likely rise as a percentage of transaction value and in absolute market value.

Is Bitcoin Worth It?

Functionally speaking, bitcoin replaces existing technologies for saving and international money transfer. It is useful to think of the improvements bitcoin brings to the functions of central banking as technological upgrades. A clear picture emerges from the comparison of the full costs and benefits of bitcoin and fiat. Fiat is a manual technology, highly vulnerable to human error and exploitation. Bitcoin is a digital and mechanical, predictable technology with very high reliability. Instead of struggling with an average 14% supply inflation rate of government monies, bitcoin offers you a fixed supply with a predictable declining supply inflation rate. Instead of a monetary policy run by politicians and special interests, bitcoin offers perfect predictability and transparency. Instead of financing unaccountable, limitless government spending, bitcoin finances the development of cheap reliable energy resources all over the planet. Instead of shipping heavy lumps of rock across oceans and melting and recasting them, bitcoin uses proof of work to ensure far less human labor is involved, and far less security risk is incurred. Instead of fomenting violent and vicious power struggles domestically and internationally over control of the monetary system, bitcoin resolves the validity of its ledger voluntarily with electric power and no violence. Bitcoin cannot end war, but it can significantly dent the state’s ability to use inflation to finance war, and, perhaps more importantly, it massively reduces the spoils of war by taking the monetary system out of it. Rather than conflict and dominance, bitcoin allows the redirection of monetary energy to the development of cheap and plentiful energy for humanity.

The washing machine saves humans time on hand-washing and delivers us a superior washing experience by consuming electric energy, which people willingly pay for, because they value the output more than the cost. The car similarly consumes a lot of energy, but people willingly pay that price to travel faster and safer, and to not deal with horse manure. Steel-reinforced houses require power-hungry coal-fired furnaces to produce their steel, but people willingly pay the cost to live in sturdy houses that protect them from the environment. A computer requires far more energy to operate than an abacus, yet computers continue to be purchased in increasing quantities worldwide. Virtually everyone on earth who has a choice between manual washing and washing machines, between walking long distances and driving, between an abacus and a computer chooses the more energy-intensive option.

The millions of people who have chosen to hold more than $800 billion of economic value in the bitcoin network are clearly making a similar judgment to these users of modern energy-intensive technology. Generating energy and using it to operate faster, better, safer, more precise, and more reliable machinery is the essence of human technological progress and human civilization itself. Electrification has massively improved countless human products, and bitcoin is just another electric product humans are adopting rapidly. No matter how large its energy consumption, that quantity is only growing because of real-world demand for its service. Objecting to bitcoin’s energy consumption is Luddism, no different from demanding others forsake any useful modern technological product for sentimental, nonsensical reasons. Fortunately for bitcoin users, the luddites are powerless to stop bitcoin from operating.