Table of Contents

Bitcoin Mining: Antifiat technology

As discussed in the first section of this book, the fiat standard solves the problem of spatial salability of physical money by replacing the need to move the physical money with government-controlled fiat payment networks. By establishing a monopoly on the issuance and clearance of monetary tokens, fiat converts all underlying monetary assets into virtual tokens arbitrarily assigned or deleted by the central fiat node. Any transaction can be reversed, any balance can be confiscated, and large amounts of these tokens can be conjured out of thin air into any particular balance—all purely by fiat. All value and truth in the banking system can ultimately be decided politically, and as time goes by, this kind of assignment of value overtakes economic production as the source of wealth creation in a fiat society.

Supplanting free-market economic forces as the determinant of value with political connectedness degrades and destroys the institutions and economic arrangements of society. The longer fiat monetary systems operate, the more they come to resemble a loyalty rewards scheme for the government. When the path to power and wealth lies in political control of the financial system, economic actors will spend fortunes in order to influence politicians and agents of the central government. Domestic and international politics are more likely to degenerate into violent conflict when the winner gets control of the mechanisms for capriciously creating and destroying wealth.

Bitcoin offers an entirely different technology for operating a monetary and financial system, a system built entirely on verification, with no functional role for fiat authority. To transfer the control of a certain number of coins from one address to another, the network requires the command of the private keys associated with the sending address—nothing else. No economic, financial, political, or religious form of authority is capable of transferring coins without the associated private keys, neither can they reverse the transfer of coins by someone who controls their private keys. This technology is what makes bitcoin a neutral, apolitical technology for money and payments. Using bitcoin is more akin to the use of a knife or wheel than a credit card; it is a technology that just does its job if you use it properly, and it doesn’t require the supervision of authorities to work. At some point in time, telephones required a manual operator made of flesh and blood to connect your call to the party you wanted to contact. The automation of telephones reduced the cost of calling to an infinitely small fraction of its manual cost. Bitcoin is the implementation of this concept to international transfers and monetary policy.

Proof of work is the remarkable engineering feat that allows for the automation of record keeping. This unique technology completely obviates the role of any supervisory authority. Thanks to proof of work, no central government or major financial conglomerate can tamper with or alter the transactions verified on the blockchain. The decentralized nature of bitcoin ensures that everyone, rich and poor alike, plays by the same set of rules. Bitcoin is a network of nodes that voluntarily choose to arrive at consensus on the record of transactions and ownership. Proof of work is the technology that allows automated consensus formulation within a predetermined set of rules, without deference to any particular authority. It’s a system of rules without rulers.

In the bitcoin system, every node is free to use any record of transaction or monetary policy it desires, and no authority can stop it from, or punish it for, using fraudulent records. But in order for the node to be operating in consensus and synced with the network, it needs to only consider additions to the blockchain presented by miners who have solved the proof-of-work mathematical problems. Nodes can verify the validity of transactions miners want to add to blocks, as well as the validity of the proof-of-work solution, very cheaply and almost instantly. However, presenting transactions to the network is very expensive for miners, because doing so requires the solution of the proof-of-work problem, which requires running mining equipment and consuming electricity. Thanks to the difficulty adjustment, that cost is always close to the reward from mining the block. This asymmetry between the cost of solving the proof-of-work problem and the cost of verifying the solution is at the heart of bitcoin’s security model. This asymmetry makes it expensive for miners to commit fraud—or even attempt fraud—and makes the problem of arriving at consensus between nodes very easy, as they only have to consider and audit a very small number of blocks, those presented by miners who solved the proof of work.

Agreement is easy when fraud is expensive to present but cheap to reject. By ensuring the cost for presenting each new block is always roughly in the range of the reward that comes from it, bitcoin nodes streamline and compress the computational and political burden of arriving at consensus, allowing them to achieve it peacefully, reliably, indisputably, and simply.

In any monetary system that does not employ proof of work, the cost of attempting fraud, fake transactions, or inflation is small. Fraud can be tried cheaply with huge potential upside in the absence of proof of work. Financial claims and disputes naturally multiply in large economies, and these conflicts require adjudication and punishment, which will ultimately lead to the development of some form of authority able to decree validity and overrule the decisions of others. A monetary system without proof of work is ultimately subjective, and given humans’ self-interested nature, and given the historical track record, such systems don’t remain neutral for long. Instead, they operate based on the outcomes of political and military conflict.

One can view proof of work as an efficient technological replacement for political and geostrategic conflict as a way of determining the validity of a record of transactions. When using fiat currencies and their attendant monetary infrastructure, one is reliant on the honesty and competence of the government authorities controlling them. When one uses bitcoin, no reliance on any particular individual or authority is required. The bitcoin network will clear the transactions and maintain the monetary policy because it is a mechanical process that only requires that some humans, anyone anywhere, desire to profit from the users and receive the block reward.

Bitcoin effectively puts the truth of the ledger up for sale to the highest bidder but attaches a very high cost to the bid, and it provides the other members of the network with a very cheap mechanism to detect fraud and rule-breaking. As a result, the bidders have an overwhelming incentive to be honest, and many thousands of network members arrive at peaceful, noncontroversial consensus roughly every ten minutes. The key to making this system work is that the bidder has to expend resources to make their claim; the bitcoin network nodes do not consider blocks presented without the solution to the proof-of-work problem, and that has proven an effective mechanism for guaranteeing that bids are only made by people who have carried out activities with demonstrable “unforgeable costliness.”

The fiat system’s payment rails do not require proof of work to function, but the fiat system effectively still does. While very little cost or energy is needed to update fiat ledgers, a lot of energy is spent to acquire the ability to control that ledger in the form of political conflict and war. Fiat is a technology that allows whoever is in power to expropriate all other users, so nation-states will fight for power and expend a lot of energy to secure it. The cost of proof of work in a fiat system—and the control of the ledger—ultimately comes down to raw power: war. The ledger will always be determined by groups with the ability to direct overwhelmingly large amounts of energy in short bursts at enemies to force them to accept a version of consensus.

Military conflict is ultimately a contest of power in its most primitive sense, as the winner is the one able to move more equipment and channel more kinetic energy into the destruction of its enemy. The first world war birthed fiat money in England, and the second world war placed the U.S. at the pinnacle of world power, giving it the ability to architect the postwar fiat system and export its inflation to the world. U.S. monetary supremacy is to this day propped up by military power through a network of military bases spread across the entire planet and a large fleet of aircraft carriers ready to deploy overwhelming military might and explosive power across the planet at very short notice. This expression of sovereign power allows the flow of the dollar worldwide, keeping it as the underlying base layer of the global monetary system. The power expenditure needed to maintain the U.S. military’s imperialism abroad, and the constant churn of wars the U.S. carries out across the globe, represents the work and energy expenditure required to keep the dollar, and its supervisory authorities, in charge of a global financial system that facilitates the movement of capital worldwide.

The point of this analysis is not to rail against U.S. foreign policy, much as that would be deserved, but to illustrate that in a world in which billions of people are spread out over two hundred countries across the globe, there are no easy ways for them to all trade with one another using one monetary system if they do not all submit to the same political authority. If the U.S. had spent the entire twentieth century following an isolationist foreign policy, another government would likely have taken over the role of the world’s central banker. A world of fiat money requires a central global authority to impose rules on all transacting parties, and the reward for being that authority is enormously attractive. With fiat as the pinnacle of monetary technology, the alternatives to U.S. global imperialism are likely to be imperialism by another country, or perpetual conflict combined with the Balkanization of monetary systems, and consequently, of trade areas, reducing the extent of trade and division of labor worldwide, with devastating humanitarian and economic consequences. Regardless of whichever political authority controls the system, fiat’s proof-of-work mechanism is simply too costly and inefficient.

Bitcoin is an ingeniously efficient technological workaround for the political conflict that is the hallmark of fiat. Instead of having the work done on battlefields, bitcoin front-loads the work into highly efficient machines, bitcoin miners. Anyone can choose to be in charge of updating the global ledger of transactions; they just need to pay the going market rate for the honor. This is similar to the reality of the fiat system, where anybody can control the local payment system and the distribution of local fiat tokens if they take over their central government and central bank, and anyone can potentially take over the global monetary system if they are to defeat the U.S. in military conflict. Technological progress and global trade allowed fiat money to effectively destroy the honest model of money offered by gold and replace it with a model where might makes right.

Bitcoin formalizes the reality that power controls the ledger but brings the power expenditure forward and subjects it to infinitesimally cheap verification by all network members. By using the network, bitcoin members implicitly accept this security model and trade-off: no single authority can decide what is correct and fraudulent, and anyone can present any record of transactions they want, but they can only do so after expending costs roughly equivalent to the amount they stand to gain from the block of transactions they present. Bitcoin is based on a sober recognition of the reality of power and an ingenious engineering solution to tame this power with voluntary verification in the service of truth and peace.

Difficulty Adjustment: The Secret Sauce

In order for bitcoin to operate, its security model requires that miners expend resources before they are able to provide blocks to be added to the consensus chain of transactions. For this to work, the value of the proof of work needs to be high enough that it discourages spam attacks, but also not too high so as to discourage even honest miners from mining. Bitcoin ensures this is the case by deploying an algorithm for adjusting the difficulty of mining, or the expected time to solve a proof of work problem.

Bitcoin miners solve proof of work problems is by repeatedly guessing the answer and checking it. The guessing of the number is a probabilistic process, and the more processing power is dedicated to the guessing, the more guesses are made per unit of time, and the faster the correct answer will be arrived at. The bitcoin mining difficulty is a measure of the difficulty of guessing the correct answer. It is adjusted every two weeks as a way to calibrate the time it takes the current computing power on the network to arrive at the correct solution to ten minutes.

At its inception, the bitcoin difficulty was set to 1, meaning that the computers on the network would be expected to solve the proof of work problems in 10 minutes on average. As the computers on the network increase, the time it takes them to arrive at the solution will decline, and blocks will start arriving faster. If the processing power on the network were to decline, the time it takes to clear blocks would be longer than ten minutes. With every 2016 blocks, or two weeks approximately, the time of block clearing is compared to the 10 minute optimum, and the difficulty is adjusted to attempt to calibrate the time to 10 minutes with the average processing power that was present over the previous two weeks. It’s important to remember this is not a precise process, but a calibration that takes place over two weeks. Block times are rarely at exactly 10 minutes, but the average blocktime stays close enough to ten minutes in the long run.

Most elements of bitcoin’s architecture are not original to bitcoin, and had existed before it. Public key cryptography, peer-to-peer networks, proof-of-work, hashing, and Merkle trees had all been invented many years before bitcoin. The genius of bitcoin was in combining them all together, and the magic ingredient that made this recipe possible is the mining difficulty adjustment algorithm.

The mining difficulty adjustment is the link between the bitcoin network and the world’s economy, and what allows bitcoin to operate at whatever scale it is demanded without needing to alter its structure. Adjusting the difficulty to calibrate around 10 minute block times means that the network will continue to maintain its monetary policy with coin production not deviating from its set schedule, and that the security model discussed above remains intact: the cost of presenting a block for the network is always close to the cost of the reward for doing so.

As the value of the network grows, the difficulty adjustment raises the cost of committing the transactions to the network, making it more expensive to attack the network with fraud, inflation, or disputes. The difficulty adjustment ensures the security of the network by ensuring the cost of mining a new block is roughly equal to the mining block reward. As the price of bitcoin rises, the amount of resources dedicated to mining bitcoin rises, and the value of an attack on the bitcoin network, in the form of inflation or fraud, also rises. The difficulty adjusting upward ensures that the cost of submitting a block for the network nodes rises commensurately as well.

The difficulty adjustment simply takes everything in the economic reality of the world and how it deals with bitcoin and turns it into one metric: the block time. It adjusts the difficulty to calibrate the blocktime around the desired 10 minutes, so the protocol continues to function as expected, irrespective of demand. It is this property which makes bitcoin the only liquid commodity with a strictly limited supply, and the only one whose supply cannot respond to increased demand. Regardless of how many more computers join the network to mine bitcoin, there is no increase in the supply of bitcoin, only an increase in the difficulty of mining it. This automatic adjustment is how bitcoin is uniquely different from all other monetary assets. If demand for any metal increases, the production of that metal will accelerate, and thus its supply will grow at a quicker rate than previously. For every other market commodity or monetary asset, the increase in demand will generate more supply, but for bitcoin, the increase in demand only results in increasing the security of the network.

Bitcoin mining is like a sports competition: there is only one trophy to be handed out, and even if more people compete, more trophies aren’t made; winning the trophy just becomes harder. This effectively ensures that the cost invested in producing a bitcoin is roughly equal to the value of a bitcoin, which is what ensures bitcoin is hard money. If a miner could produce bitcoin cheaply, it would be so profitable that other miners would join, and the difficulty would rise, increasing the cost of production until the profit is eliminated, or preserved for only the miners with the lowest electricity cost.

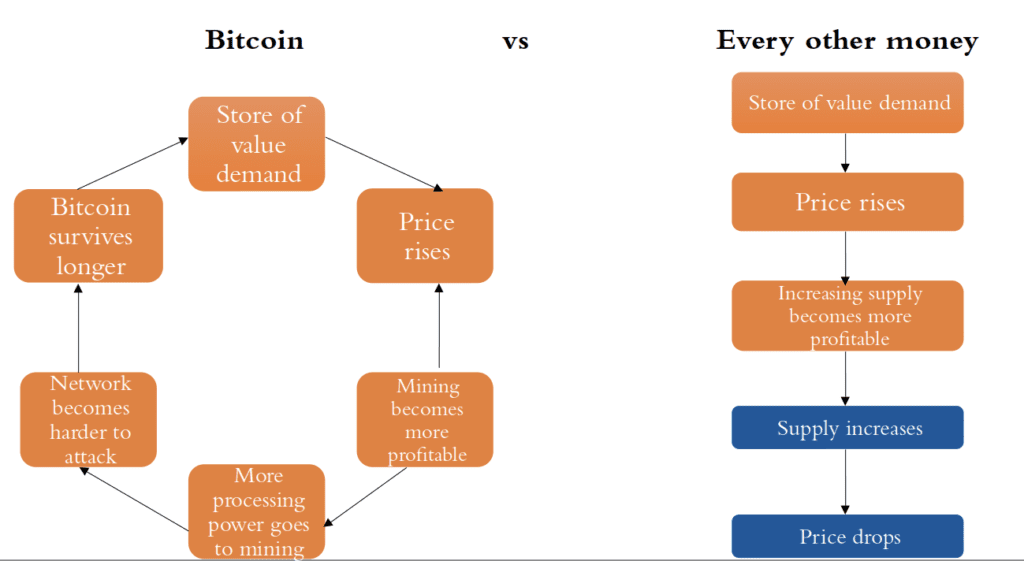

Difficulty adjustment is the crucial ingredient missing from previous digital currency attempts that allowed bitcoin to succeed. It ensures that the cost of producing a bitcoin always trends close to its price, thus ensuring that bitcoin remains hard money, where nobody is able to produce money at a cost significantly and persistently different from the market price. The difficulty adjustment also turns bitcoin into an indomitable, all-conquering positive feedback loop of economic incentives, as visualized in figure 1. Only by understanding the difficulty adjustment can one understand bitcoin’s tremendously quick rise in value.

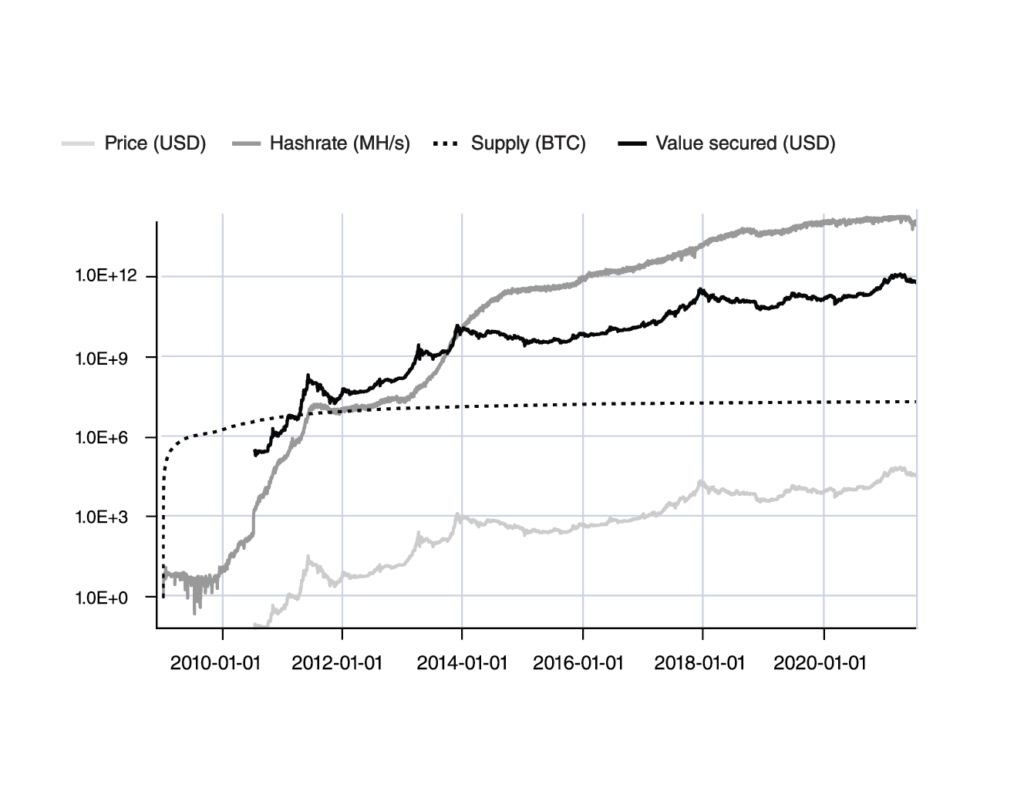

As the bitcoin price has risen over time, bitcoin production has proceeded according to the original schedule, while the amount of processing power dedicated to the network, in terms of hashrate, has continued to rise inexorably. As the security has increased, so has the value stored on the network. Difficulty adjustment converts demand for producing more bitcoin into more security for the bitcoin network, while ensuring the supply continues to only grow according to the predetermined schedule.

To be secure, bitcoin does not need a fixed sum of electricity or hashrate. Instead, it needs to create a liquid market in electricity and hashing power that constantly attracts a serious amount of capital infrastructure to produce mining hardware. By simply providing a highly liquid instrument as a reward for expending electricity and processing power, bitcoin continues to attract the most efficient producers of electricity and processing power to monetize their resources. As long as this unique market continues to exist and offers valuable rewards, it will make any attack considerably expensive and unlikely to succeed. In particular, bitcoin’s impact on the electricity market means that it is a voracious buyer of any cheap electricity that exists anywhere in the world. Whereas any attacker would need to mobilize enormous amounts of expensive energy in centralized locations to try to attack the network, bitcoin can draw on the cheapest sources of energy in many locations worldwide by offering rewards for selling electricity that producers would not be able to sell elsewhere.

Ultimately, doomsday scenarios in which bitcoin fails due to a technical design glitch do not take into account the economic incentives it provides to keep the system running successfully. As long as demand for digital hard money exists, many millions of people around the world are motivated to find solutions to continue its existence. Bitcoin has a very straightforward technical requirement to operate, and it performs a very simple job that requires very little technical sophistication but enormous incentives.

Bitcoin Fuel

One of the most common misconceptions about energy is that it is scarce or limited. In the popular imagination, the earth has a limited supply of energy that humans consume whenever they heat or move anything. This scarcity perspective views energy consumption as a bad thing because anything that consumes energy depletes our planet’s finite supplies of energy. Mainstream media and academia act as if energy is a zero sum game, whereby any individual consuming energy in the world is taking it away from others. Reality is very different. The scarcity of energy lies not in its absolute quantities, but in having it delivered, at high power, at the time and place where it is desired.

The total amount of energy resources available for humans to exploit is practically infinite, and beyond our ability to even quantify, let alone consume. The solar energy that hits the earth every day is hundreds of times larger than global energy consumption. The rivers of the world that run every hour of every day also contain more energy than global energy consumption, as do the winds that blow, and the hydrocarbon fuels that lie under the earth, not to mention the many nuclear fuels we have barely begun to utilize.

To begin with the most obvious of energy sources, the sun alone showers the earth with 3,850,000 exajoules of energy every year, that is more than 7,000 times the amount of energy humans consume every year. In fact, the amount of solar energy that falls on earth in one hour is more energy than the entire human race consumes in one year. The amount of wind energy alone blowing around the world is around four times the total energy consumed worldwide. Some estimates put the potential hydroelectric yearly power capacity at around 52 PWh, or a third of all the energy consumed in the world. The earth’s reserves of hydrocarbons continue increasing every year with increasing human consumption, because as consumption increases, so does oil prospecting and excavation and new technologies like hydraulic fracturing. Energy companies discover more and more reserves all the time.

Humanity does not have an energy scarcity problem because energy cannot run out so long as the sun rises, the rivers run, and the wind blows, and because the hydrocarbon and nuclear fuels under the earth are far larger than our ability to even measure. Energy is constantly available for humans to use as we like. The only limit on energy availability is how much time humans dedicate toward channeling these energy sources from places where they’re abundant to places where they’re needed. All energy is ultimately free if you don’t think of the cost of channeling it to the right place at the right time at the right intensity. Energy costs come from the need to pay the supply chain of individuals and firms to transport this energy to where it’s needed and in a usable form, at specific quantities over specific periods of time. Therefore, discussing energy as a scarce resource, which implies a fixed, God-given quantity for humans to consume passively, makes no sense. In its usable form, energy is a product that humans create by channeling the forces of nature to where they are needed. As with every economic good other than bitcoin, there is no natural limit to the production of this good; the only limit is how much time humans dedicate to producing that good, which in turn is determined through the price mechanism sending signals to producers. When people want more energy, they’re willing to pay more for it, which incentivizes more of its production at the expense of producing other things. The more people desire it, the more of it can be produced. The scarcity of energy, like all types of prebitcoin scarcity, is relative scarcity, whose cause lies in the opportunity cost in terms of other goods.

Bitcoin mining is unique in being an energy-extensive and highly profitable use of energy that can operate from anywhere and can sell its output digitally. Bitcoin requires an ever-growing expenditure of power in order to arrive at consensus without having to trust in a single authority. And to secure that power, the network’s design initiates relentless competition between potential miners to find the cheapest sources of energy worldwide, and to deploy their equipment most efficiently. Bitcoin will buy cheap energy wherever it is located and however it is produced, and to do so, it requires no expensive pipelines, trucks, tankers, or trains—just an internet connection at the energy source’s electric output. Bitcoin is an entirely new technology for buying electricity digitally, with a profound transformative impact on how electricity can be produced and sold, making it more fungible and liquid. Unlike all other uses of electricity, bitcoin does not require power to be transported to it; it can buy the power anywhere it is available and is insatiable in its demand of cheap, reliable electricity. The implications of this single point are only beginning to be understood.

1. Waste energy

The inescapable conclusion one reaches after understanding the bitcoin difficulty adjustment and the geographic mobility of bitcoin mining is that bitcoin will inevitably consume cheap, wasted, and stranded electricity—energy with zero opportunity cost. Mining is consistently profitable only for the miners who mine using electricity secured at rates significantly cheaper than the majority of world electricity prices. The global average price of electricity is estimated around fourteen cents per kWh. At any particular price of bitcoin, there are billions worldwide who have access to electricity which they could use to mine bitcoin at a price of fourteen cents per kWh or less. As more of these people attempt to mine bitcoin, the difficulty of mining rises, thus reducing the expected return to bitcoin miners, eroding the profitability of miners mining at higher prices of electricity. As the difficultly adjusts upwards, miners who cannot find inexpensive electricity will start mining at aloss. As losses accumulate, these miners eventually go out of business, leaving behind only those with significantly lower cost of electricity. The entire bitcoin network collectively finds and rewards cheap, stable, efficient electricity.

Reliably profitable mining operations are those able to secure stable electricity at rates lower than five cents per kWh. At higher electricity rates, miners can be profitable during periods where the bitcoin price rises quickly, but they will lose profitability when the price goes down or when difficulty adjusts upward. The nature of bitcoin’s difficulty adjustment is to create ruthless competition between miners. This competition means only those able to secure electricity at extremely cheap prices will thrive.

Wherever energy is in high demand by residential, commercial, or industrial facilities, using that energy to produce bitcoin will carry a significant opportunity cost, as there are people who would pay to use it in their daily life to meet their needs, whereas isolated and stranded energy sources have no alternative demand, and thus carry a zero opportunity cost. In many places, the energy has a negative value, as it is a nuisance or danger, which is expensive to dispose of safely. For example, excess gas at hydraulic fracturing sites is normally flared off and wasted. Hydroelectric dams can have overflows of water. Volcanoes can erupt, producing dangerous amounts of fumes and lava. This energy is difficult to utilize because transporting it to residential and industrial centers is expensive.

Given the high costs of transporting and storing energy, electricity production leads to very large quantities of power getting lost in the attempt to move from suppliers to consumers. In 2019, the world produced around 173,000 TWh. Around a third of that energy is wasted, leaving humanity to consume around 117,000 TWh. The entirety of the bitcoin network currently consumes around 120 TWh, or around 0.1% of the total energy wasted in the world. But unlike all other uses of energy, bitcoin can consume—and in all likelihood, is consuming—the energy that would have been otherwise wasted.

With the invention of bitcoin, the methane that would otherwise be flared, the rivers that would otherwise overflow, the abandoned oil fields, and the volcanoes that would otherwise erupt can be monetized, channeled, and consumed. Difficulty adjustment ensures that bitcoin is only mined with the electricity sources with the lowest opportunity cost, and that incentivizes the mass of bitcoin miners to locate and use inexpensive energy.

Bitcoin could grow 1,000-fold and still not consume more energy than humanity has wasted. Bitcoin will continue to grow by consuming this energy, primarily, because this energy has a zero opportunity cost and very few potential buyers other than bitcoin, if any. All other electricity that has demand will find a higher bidder than the bitcoin network because the bitcoin network can buy the cheap electricity at prices unavailable to those who need valuable electricity near large demand.

2. Bitcoin Incentivizes Energy Generation

The essential property of capital goods is to increase the marginal productivity of the producers who use them. The fisherman who catches fish with a modern trawler has a much higher hourly productivity than the fisherman using a little boat and net, whose productivity is in turn higher than that of the fisherman on the coast holding a fishing rod, whose productivity is higher than anyone trying to catch fish with his hands. As the stock of capital increases, the marginal productivity of the worker increases, and that is why countries that have higher capital stocks have higher income than poorer countries. The march of human progress and civilization is the march of capital accumulation to produce more output per unit of effort expended by a human being. The more capital is accumulated, the more productive humans are, and the lower the marginal cost of the goods produced.

Applying this analysis to the question of bitcoin power consumption has startling implications. Bitcoin isn’t “consuming” the world’s energy; bitcoin is providing a powerful market incentive for energy producers worldwide to increase the production of cheap energy. By giving a large financial incentive to anyone able to mine at an electricity cost below that of the market, bitcoin makes the development of cheap, reliable sources of electricity, anywhere in the world, very rewarding. This financial reward in turn leads to growing investment in capital infrastructure for cheap energy sources, which leads to increased energy production and decreased cost. This is particularly interesting in light of the discussion of Chapter 10, where we saw how fiat hampers the development of low-cost and reliable sources of energy by mandating and promoting unreliable and intermittent energy sources. Bitcoin’s growth is the antidote to the damage caused by the growth of these fiat fuels, as it continues to offer a large bounty to anyone who can produce cheap and reliable electricity. Governments may be taxing and regulating reliable energy and making it far more expensive, but bitcoin is reversing this with poetic justice: it is taking away seigniorage from governments and using it to finance cheap energy production worldwide.

The growth of bitcoin is the monetization of a digital commodity produced from electricity, and growth in demand for bitcoin will result in growth in demand for electricity. The full extent of the powerful upgrade that bitcoin represents becomes apparent when one realizes bitcoin’s monetization will drive the production of electric power, one of the most important economic goods humans ever invented, while replacing the fiat monetary system which monetizes debt and government fiat, driving the growth of indebtedness and government power. Rather than direct the benefits of seigniorage to governments, bureaucracies, lenders and borrowers, and belligerent militaries, bitcoin directs them to the production of the miraculous commodity that has allowed humanity to prosper and conquer darkness, cold, disease, and the violence of nature.

3. Reliable Energy

Computer equipment is the other major cost of mining bitcoin, and production of computers capable of mining bitcoin effectively has now grown into a highly specialized and competitive multibillion-dollar industry. The cost of these machines is also bid up as bitcoin’s price rises, and the miners who will be able to afford to pay their prices are the ones who will operate them the most profitably. To operate them most profitably at capacity, the miner must have them connected at all times to reliable and stable power. When the miner is not connected to electricity, the computers depreciate in value and fail to produce the expected return, putting the owners at a disadvantage compared to miners who can use their equipment twenty-four hours a day, 365 days a year. Miner uptime is an essential part of profiting as a bitcoin miner.

Given the nature of bitcoin’s demand for electricity, it is possible to identify a few trends in the energy sources likely to power bitcoin mining. Solar and wind power are unlikely to play a major role in bitcoin mining, as these are intermittent sources of energy, unable to produce a reliable stream of energy around the clock. Machines that run on these sources will have significant downtime, which, given bitcoin’s ruthless difficulty adjustment, means they will be unlikely to survive against miners with constant and reliable energy. As many of these sources are heavily subsidized, it is plausible that they could be used to mine bitcoin in the short term, but it is doubtful these operations can operate successfully for long. It is completely unrealistic to expect these sources to be supplemented with battery technology to store energy, as the cost of electricity coming from batteries increases by several multiples. Instead, currently available systems that are both cheap and reliable will likely grow in their share of the bitcoin network’s hashrate.

4. Bitcoin’s Energy Future

Oil, coal, and gas power plants are also unlikely to be major sources of bitcoin energy because of the high opportunity cost associated with power generation and the significant running cost of fuel supply. Hydrocarbon power plants are built in areas of high demand for reliable power, and that means their electricity prices are significantly higher than the five cents per kWh profitable bitcoin miners need. This high opportunity cost makes it unlikely for profitable mining to be performed at scale on grids connected to hydrocarbon plants. These plants could mine bitcoin with spare capacity if they have that. Bitcoin could help finance the building of large power plants accounting for future growth by allowing the operators to cover some of the costs by mining with spare capacity until demand grows. Bitcoin can also help finance the building of some margin of standby spare capacity, which would be needed for emergencies or failure of other power sources. As the world’s grids are becoming more fragile thanks to the mandating of unreliable fuels, power generators could use bitcoin mining to finance building spare capacity to bring online at the times when wind and solar inevitably fail.

Hydrocarbons are much cheaper to transport than hydroelectric energy. They are thus in high demand everywhere humans settle. They can be used for cars, homes, cities, or all kinds of other uses. They will always have a high opportunity cost, relatively, because there is always someone who could use them for something highly productive. Hydroelectric energy, on the other hand, usually has a very low opportunity cost, or even a negative opportunity cost, when one considers the dangers posed by flooding. Unlike hydrocarbons, hydroelectric energy is frequently generated far away from areas of high demand and requires little running cost, as there is no fuel needed to operate it. Unlike solar and wind, hydroelectric power has the advantage of being reliable and predictable around the clock. The average cost of electricity from hydroelectric plants is usually in the range of three to five cents per kWh, which is ideal for bitcoin miners. Operating hydroelectric power facilities away from population centers appears to be a very successful long-term strategy for mining bitcoin profitably.

Nuclear power is also likely to be suitable for mining bitcoin, since it is usually very cheap and reliable, and since many nuclear plants have the ability to produce a lot of power that may exceed local demands. And as mentioned earlier, another very important potential source of mining is the flaring of methane gas from oil fields. The production of oil leads to the inevitable production of large amounts of methane gas which is unprofitable to transport from remote oil fields. Oil fields usually flare, i.e., burn, this energy, but bitcoin is able to buy it on-site by installing a generator and miners. Waste incineration plants are another potential source, as these are usually situated far from population centers.

The total amount of methane that is flared and burned away every year contains 1,500 TWh of energy,107 which is around ten times larger than the consumption of the bitcoin network. Hydroelectric energy alone produced 4,306 TWh in 2019, or more than thirty times what bitcoin consumes. With bitcoin allowing for the building of hydropower plants in areas unconnected to major grids and population centers, the generation capacity of hydropower can increase much further. With spare nuclear capacity, as well as backup and spare capacity in hydrocarbon-powered plants, there is ample room for bitcoin to grow purely on spare capacity, wasted, and stranded energy sources at very low costs. The hysterical screeching by fiat media and academia about bitcoin consuming all the planet’s energy is completely unfounded. Difficulty adjustment ensures bitcoin’s energy consumption will predominantly draw on sources with very low opportunity cost.