Table of Contents

According to the “World Payment Report 2020” by Capgemini and BNP Paribas, 708.5 billion non-cash transactions took place around the world in 2019 (about 1.94 billion transactions per day). The report further expects this trend to continue until there are 1.1 trillion annual non-cash transactions by 2023, which is around 3 billion transactions per day. For comparison, the highest daily transaction volume that the Bitcoin network has ever achieved is 490,459, which happened on December 14, 2017. In the three years up to May 2021, the average daily number of transactions was 297,476, with a standard deviation of 50,682. Assuming bitcoin can process half a million transactions a day, that effectively means it can process approximately 0.025% of non-cash transactions in 2020, or 0.0167% of all non-cash transactions expected to take place in 2023. Put differently, if Bitcoin is to handle all global digital payments in 2023, it needs to increase its transaction capacity by around 6,000-fold in the next two years.

The current bitcoin transaction capacity is being achieved at a block size of around 1 megabyte. The naively obvious approach to scaling simply suggests an increase in the size of blocks until they are large enough to accommodate whatever number of transactions is needed for Bitcoin to take over the world. This was the scaling approach favored by the doomed hard fork attempts Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited and Segwit2x. It was also the driver of the doomed Bcash hard fork (as well as its own even more doomed hard fork, BcashSV). The sorry history of all these poorly thought-out attempts is well worth revisiting in-depth, and Kyle Torpey has written many articles on their failures. The important conclusion from all these episodes is that increasing the block size is not a workable scaling solution because even relatively small increases wouldn’t move the needle, and would come at the expense of a significant increase in the cost of running a bitcoin full node, likely reducing the number of full nodes, which is ultimately the only guarantee of Bitcoin decentralization and immutability.

Bitcoin’s core value proposition of immutability is enforced by strong consensus rules which only full nodes enforce. This enforcement ensures its uncensorable nature and hard monetary policy. Increasing the block size to improve scaling has proven highly unpopular with bitcoiners because it compromises the network’s decentralization and makes it harder for the average bitcoiner to run a node. Anyone who attempts it will likely end up with a pointless altcoin like the many thousands out there. Even if bitcoiners were to sacrifice decentralization and adopt much larger blocks, it would not provide the orders of magnitude increase in scalability needed for bitcoin to handle all global transactions.

To handle all global transactions, bitcoin would need to scale to blocks of around five gigabytes each. This means that every computer on the bitcoin network would need to download this much data roughly every ten minutes. Each computer must also have the disk space to store all these massive blocks, which would accumulate at a rate of almost 0.7 terabytes per day, indefinitely.

This is roughly equivalent to the total hard disk space on today’s average commercial computer, implying that no commercial computer owners would be able to download the bitcoin blockchain. Only people who can afford highly advanced computers would be capable of running a full node. Such a form of bitcoin would have few people running full nodes. As a result, it would be under serious threat of either capture or centralization. Having only a few dozen full nodes worldwide makes it relatively straightforward for them to collude to change the rules of consensus, as fiat nodes did in 1914.

Fortunately, other solutions exist that can increase on-chain transaction capacity while avoiding a blocksize increase. Many of the recent improvement proposals promise more efficient transaction handling. But even with all of these improvements, there are hard limits to how many transactions Bitcoin’s ledger can record. No matter what optimizations are performed, the bare minimum needed for a single payment to take place is the data needed for the transaction output, which is still bytes of data per transaction. Assuming four Megabyte blocks, even the most theoretically efficient use of block space would translate to around 17 million daily transactions, still a far shout from what would be needed for handling all global transactions.

Hard Money Cannot Stay Niche

Since bitcoin’s decentralization is the only thing that makes it valuable, its transaction capacity cannot possibly come at the expense of a reduced number of full nodes. Does this mean that bitcoin is doomed to never scale? Does it remain a niche network processing a few million transactions a day? Could bitcoin become the monetary equivalent of the Esperanto language? A fringe group of enthusiasts using a protocol that is unintelligible to most people?

Hard money is by its very nature a viral and all-conquering technology. It simply cannot be restrained from growing. Monetary history is repeatedly about harder money destroying and eventually replacing the value of easier money. Hard money cannot coexist peacefully with easier monies around it. That situation is an unstable equilibrium. When Europeans found West Africans using beads for money, they took advantage of the fact that the beads are cheap to produce in Europe but expensive to produce in Africa. They brought in enormous quantities of beads to purchase everything valuable in West Africa. There was no way for beads to remain as money in Africa, no matter what the feelings of their holders. Anybody who chose to continue using them as money completely lost their purchasing power; in effect, the beads ceased functioning as money.

The existence of a harder money and other human beings acting in their self-interest will very severely limit your choice as to the type of money you can use. This is not just about finding someone willing to accept the money you have. More significantly, it is about the consequences for the money you hold that results from people producing it at a cost lower than its market value. That harder money will keep value better than the easy money over time, as its supply increases by relatively smaller quantities.

As the relative value of the two forms of money begins to change in opposite directions, the harder money’s pool of available liquidity increases compared to the easier money’s pool. In other words, the probability of wanting to trade with someone willing to pay with or accept hard money increases. The appreciation in the value of a money results in an increase in its salability, or the likelihood that an individual will be able to sell it when they need to dispose of it.

Salability, as Carl Menger emphasized, is the key property of money. Hardness is key to salability because it constantly serves to increase the relative value of the pool of liquidity available for trade. This process is naturally accelerated when people understand it and rationally choose the hardest money. Over time, as increased wealth shifts toward harder money, more people would want to use it. Thus, the demand for it must increase. The demonetization of silver, discussed in The Bitcoin Standard, and the countless failures of inflationary national currencies are further illustrations of this inexorable trend.

This brings us back to the earlier comparison between bitcoin and the World Payments Report statistics. The 708.6 billion transactions mentioned above were specifically called “noncash transactions” for a reason: they involve intermediaries processing the payment. While these transactions are mostly digital today, that does not make them categorically similar to bitcoin transactions in economic terms. Even though it is digital, a bitcoin transaction is still a cash payment because the payment is not the liability of anyone. Bitcoin is a form of cash because only the bearer is able to dispose of it, and they can do so without the need for the consent or permission of a third-party intermediary. Bitcoin as digital cash is more comparable to the physical transfer of physical money, such as in-person cash payments, or final settlement transactions, or movements of gold between gold clearing banks or central banks. It is not really comparable to the noncash payments, even though the two might appear similar because they are both digital. Bitcoin’s essential quality is not that it is digital but that its transactions are free of counterparty risk.

Those who expect bitcoin to grow by displacing intermediated noncash payments have completely misunderstood its fundamental nature. If bitcoin is to continue to grow, it will grow primarily through an increase in the value of the cash payments or the final settlements it performs. It will not grow through an increase in the number of transactions. Payment solutions are being built on top of bitcoin through secondary layers. The trend toward higher-value transactions is already underway and will likely accelerate as users increasingly adopt second-layer technologies for lower-value transactions, which will involve trade-offs in security and censorship resistance.

Bitcoin block space supply

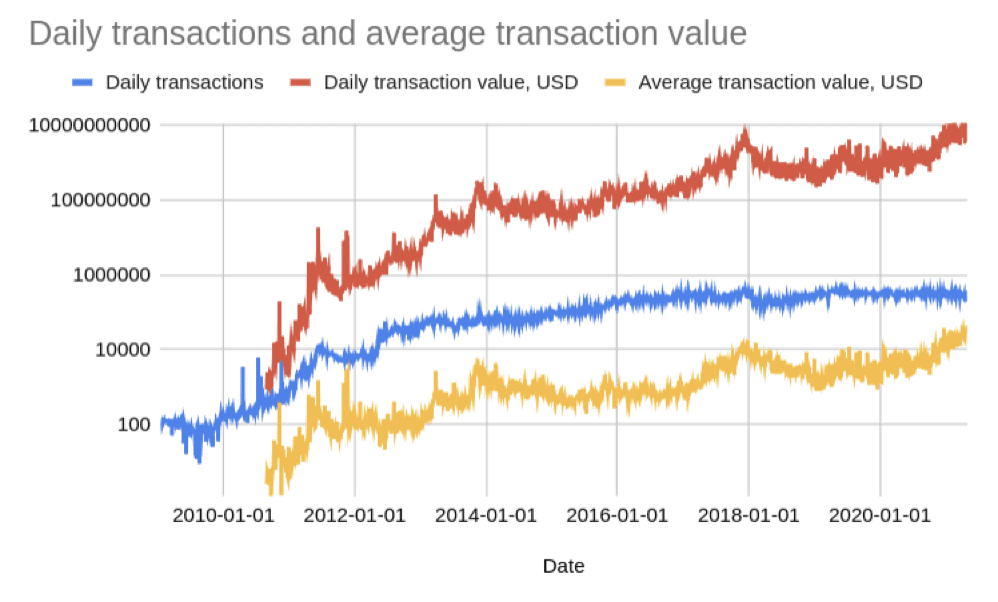

A look at the twelve years of Bitcoin’s existence shows these trends unmistakably. As the chart below shows, while the number of daily transactions has grown, it is far outpaced by the increase in the value of these transactions. Comparing the most recent year of data (May 2020 to May 2021) to the earliest year of data, we find that the yearly average value of a bitcoin transaction has increased by 150 fold. Daily transaction number has practically stalled for the last five years, mid-2016 to mid-2021, in the range of 200,000 to 400,000 transactions, while the value of transactions has increased roughly fifteenfold over the same period.

As demand for bitcoin has increased, bitcoin has not scaled through a larger number of on-chain transactions but through on-chain transactions having increasingly large value, both in bitcoin terms and U.S. dollar terms. This trend should continue as demand increases. With a fixed block size, there is a hard limit on how many transactions can be done on-chain. Even assuming non contentious forks can increase the block size, they will not be adopted unless they avoid compromising average users’ ability to run their own nodes. This means that any block size increase will likely be slow and gradual. Growth in demand for holding bitcoin, on the other hand, does not have the same hard limit. Should bitcoin continue to maintain its core value proposition as a hard money whose supply is perfectly predictable, the growth rate of demand for it will far exceed its ability to handle individual on-chain transactions.

The economics of bitcoin’s block space beautifully illustrate market dynamics at work. Its scarce nature necessarily means that a bidding war will ensure only those who value block space the highest will get it. Over time, this pressure has outpriced several types of transactions from being registered on-chain, and now most are settled off-chain, either through second-layer solutions or through custodial internal ledgers. Today, many bitcoin-based businesses conduct a majority of their transactions in bitcoin on their own internal databases, and only use the Bitcoin blockchain for final settlement to and from the business. Gambling websites, for instance, will record all bets and winnings on their internal ledgers and will only use the bitcoin blockchain when a user deposits or withdraws bitcoin from the website. The same is true for exchanges, where traders speculate on bitcoin and digital currencies. For each on-chain transaction, several thousands of bitcoin-denominated transactions can occur and settle on internal and private ledgers. This contrasts with the situation in the earlier days of bitcoin when betting services would record thousands of transactions daily on the bitcoin blockchain. As transaction fees on the network have risen, these models are no longer sustainable and have changed to rely on the bitcoin blockchain for final settlement only.

Should demand for bitcoin increase significantly, many more uses like this will inevitably be priced out. Because there is no hard limit on its demand, its total daily transaction value can rise to many multiples of today’s daily transaction value. If it does, the pool of liquidity for transacting bitcoin will grow, allowing for more valuable purchases and sales to be conducted in bitcoin; this will inevitably price out the transactions of smaller value, as they will not be able to match the transaction fees of these larger transactions.

When considering the types of transactions that will remain on the Bitcoin ledger, it is instructive to think of the alternative avenues available for such transactions. By determining the opportunity cost of not using Bitcoin on-chain for various use cases, we can see which ones can afford to bid the highest for block space. Assuming market participants desire superior security and hard monetary policy, they would be willing to use bitcoin even if transaction fees are significantly higher than alternative payment solutions that rely on trusted third parties and inferior security. Conversely, if users are not as concerned with superior security and a hard monetary policy for a given use case (e.g. involving smaller value transactions), the opportunity cost of not using Bitcoin is lowered.

Currently, individual consumer payments are processed with fees of 0-3% over various payment processors. Given that market participants are less concerned with Bitcoin’s value propositions for these use cases, it would only make sense to use bitcoin for these payments if a bitcoin transaction fee were in the cents or at most single digit dollars. Similarly for international remittances, transaction fees are usually tens of dollars, which suggests that as a potential cost ceiling for bitcoin in this use case. If the use of bitcoin for these uses takes off, transaction fees will eventually rise past the cost ceiling, and it would be no longer economical for the users to conduct these transactions on chain. This feedback mechanism will continue to price out all manner of uses of Bitcoin’s blockchain and will reserve block space only for transactions that need Bitcoin’s guarantees the most. As it stands, bitcoin on-chain transactions are a tiny fraction of total bitcoin-denominated transactions, if one were to count trades on exchanges and casinos, as well as all manners of second layer transactions on companies conducting bitcoin financing.

As bitcoin transaction fees increase, one of the use cases likely to be the most willing to pay will be international final settlement payments between large financial institutions. These are by their nature the most valuable and most security-sensitive transactions today, and the closest thing to a bitcoin transaction currently in terms of their finality. They currently require days (or even weeks) to complete. Bitcoin is barely beginning to acquire the size and liquidity to allow it to conduct such payments with confidence and security. But as it grows, it will likely attract more of these transactions, which will crowd out many other use cases and push them off chain. To accommodate smaller transactions whose parties will not be able to afford block space in this market, second-layer solutions are already emerging. These bitcoin-based transaction protocols hold the promise to preserve some of bitcoin’s guarantees while relieving users of its on-chain fees.

Second-Layer Scaling

Silver coins coexisted with gold in order to accommodate the need for small transactions where gold was not feasible to use, but this arrangement was obviated by financial instruments based on gold. In the same way, second-layer bitcoin transactions are likely to displace transactions that currently take place with easier forms of money, especially as bitcoin adoption and liquidity grows. Bitcoin purists may complain that second-layer bitcoin transactions will never have the equivalent on-chain transaction security and certainty. They’re right, but that misses the point. Second-layer bitcoin transactions do not compete with first-layer bitcoin transactions. Instead, they compete with second-layer transactions with inferior monies.

While the purists will complain that these kinds of transactions will never have the same level of security as real bitcoin transactions, the scaling limitations for bitcoin’s on-chain volume discussed above make it clear bitcoin cannot scale to handle individual consumer payments.

Moreover, bitcoin transactions need about ten minutes to get a single confirmation on the network, which is highly unsuitable for individuals who expect their consumer payments to be complete much more quickly. The level of security and certainty bitcoin provides for a transaction after it has received a few confirmations is also wasteful overkill for small purchases, and the purists can do nothing to stop the economic reality of individuals preferring these second-layer payments with hard money to second-layer payments on easy money. The limitations that exist will also be present in second-layer payment solutions for other types of money. The main difference is that the payment solutions on hard money are likely to allow holders to preserve value better into the future. Given a choice between payment solutions on a hard money versus an easy money, salability across time dictates that the harder money will inevitably win.

The common mistake that many bitcoiners make when assessing second-layer solutions on top of bitcoin is to compare them to bitcoin transactions, but the more correct comparison is with consumer payment technologies that use fiat. Conceptually, bitcoin could scale to handle all the world’s transactions by next week if central banks replaced all their reserves with bitcoin this week. If the bitcoin blockchain were only used to settle large transactions between central banks (while they issued currencies fully backed by bitcoin), then all the world’s transactions would effectively be second-layer bitcoin transactions. Your government paper money, your checking account, your credit card, and your PayPal account would all become second-layer bitcoin payment solutions in that scenario.

As the number of bitcoin holders grows and more people demand payment solutions, there will be an incentive to supply them. These solutions will be optimized and tailored to work best with bitcoin as it is. This may lead to a reinvention of most of the mechanisms we use today for payment. Secondary layer transactions do not share the same level of security as on-chain transactions, but it is not clear why that level of security is needed at all for daily consumer transactions of small values. When a customer has an account with an exchange or online casino, they are already trusting that party on many different levels; allowing that party to record transactions on their own ledger after they have received the deposited customer funds adds no risk whatsoever. If they choose to abscond with client money, they could do so regardless of whether their internal transactions were recorded on-chain or off-chain. The funds are only truly under the control of the user after withdrawal from the third-party service.

As demand for bitcoin increases, these second-layer scaling solutions will only proliferate. Consequently, diverse levels of risk and safety will appear for different use cases. Opendimes are another good example. These physical USB keys are designed to be tamper-proof, and the bitcoin balance inside them can be verified very quickly. For small sums and transactions between people with a sense of familiarity and trust with one another, this is a particularly useful mechanism that allows for in-person transactions without needing to be registered on the bitcoin blockchain. While this could be unsafe for larger sums because an Opendime does not issue a backup seed phrase, bearer instrument-type technologies can nonetheless handle a remarkably high number of small transactions and allow for more liquidity in bitcoin transactions.

Multisignature custody solutions will likely also play a role in allowing for cheap second-layer payments. Holders could deposit their coins in multisig accounts, such that the coins can only be moved on-chain with both the private keys of the holder and the bank. That bank could then create a payment network for holders of such accounts on its internal databases to allow individuals to transfer ownership to each other, which would only be settled in batches with on-chain transactions at the end of the day, week, or month.

Lightning

Perhaps the most interesting and promising second layer scaling proposal is the Lightning Network, which is a new emerging ecosystem of node implementations that allows for an automated, fast, and cheap implementation of a multisig channel-based payment network. Lightning nodes open channels with one another by sending funds to a multisig address using an on-chain transaction. Each party keeps an individual balance on the multisig account, and the parties can pay each other by signing off-chain lightning transactions that reflect their updated respective balances. When either party chooses to close the channel, an on-chain transaction (reflecting the result of all the off-chain balance updates) is sent from the multisig channel address to the two parties with their respective outstanding balances.

But Lightning users do not necessarily need to build channels with everyone with whom they wish to transact, as payments can be routed through various other nodes and channels to link two parties who do not share a channel. As the number of channels and the liquidity they contain rise, the possibilities of routing payments between users increases. Individual nodes that route payments between nodes can charge routing fees to compensate them for providing the liquidity.

The strength of this approach to scaling is that the setting up and closing of a channel requires just two on-chain transactions in total. This allows both parties to conduct an effectively infinite number of off-chain transactions at zero marginal cost. Additionally, the timing of the on-chain transactions is flexible since channels can be opened and closed when the demand for on-chain transactions is low. Users can observe publicly available information about the mempool to establish whether competition for blockspace is driving up fees and vice versa. People who establish a pattern of repeated transactions can settle transactions locally on their channel, or through other channels, without having to record every transaction on the bitcoin ledger. Despite these benefits, it is important to remember that an off-chain transaction on Lightning is not as secure as an on-chain transaction. But the most important difference between the two lies in liquidity.

The real limitation of the Lightning Network is not in its security or number of transactions but in the depth of the liquidity pool in the network. The more people on the network and the more money sent to payment channels, the higher the chance that an individual can trade with someone else on the network. But the opposite is true as well, which means low liquidity may lead to higher fees and longer wait times. The provision of liquidity to the network is an overly complex web of individual economic decisions inextricably linked to people’s valuation of time and the inescapable uncertainty of the future.

Ludwig von Mises discusses how uncertainty about the future is the key driver of demand for holding money.101 With no uncertainty of the future, humans could know all their incomes and expenditures ahead of time and plan them optimally to avoid ever having to hold cash. But as uncertainty is an inevitable part of life, people must continue to hold money for future spending.

Committing a balance of bitcoin to a Lightning channel is not the equivalent of holding a cash balance. This is because the money on that channel is only useful for payment for the counterparty of the channel or others who are connected to them on the Lightning Network. It does not have the same liquidity of coins that can be spent immediately on the bitcoin network. Also, establishing channels involves nonnegligible costs in fees, time, and coordination, and a user’s channel funds are only liquid to the extent the counterparties in their channel have liquidity. Since liquidity in a channel can generate a return in terms of routing fees, it is more accurate to understand channel balances as an investment to secure routing fees, as well as an option contract: having the right but not the obligation to instantaneously send value through that channel if it is open.

Since profits can be made from providing liquidity, the best liquidity decision for a particular node is not based on individual demand for liquid cash balances but rather an investment decision based on expected returns from routing fees. If people managed their Lightning balances solely based on their need for cash balances, there would be no reason to expect sufficient liquidity to route the payments of others. But since there is a market demand for liquidity to make cheap transactions, the amount needed to meet that demand will be provided by investment in that liquidity for a return, which implies specialization. In other words, the dynamics of the Lightning Network strongly suggest that specialized node operators will emerge to earn profits in exchange for liquidity provision. The job of banks in processing payments can be understood as the provision of liquidity. In traditional finance, they are the ones able to put up cash for payments when needed. Similarly, Lightning Network growth depends on professional management and the provision of liquidity.

The management of the liquidity on channels to optimize for fees is more like a specialized commercial enterprise managing liquidity than individuals managing their expenditure between bank accounts, credit cards, and cash. It is unlikely that an extensive network of liquidity and routing could develop purely from individuals entering channels with one another. This is primarily because everyone will be bottlenecked by the liquidity held by their channel counterparties. When an individual opens more channels on the Lightning Network, they create more liquidity for it, but they will also incur higher costs involved in opening and closing many channels. In contrast, opening a channel with a single node specialized in providing liquidity (and with an extensive structure of channels open with many other nodes) will allow that person far more liquidity and reach. Specialized node operators will allow relatively new Lightning Network users to plug in to the network and immediately enjoy the benefits of bitcoin-based transactions that are quick and cheap.

The opportunity to profit from providing reliable liquidity and routing to users suggests that if the Lightning Network were to continue its growth, providing liquidity would likely grow into a profitable and highly sophisticated business. Economic efficiency suggests that the network would be far more robust if liquidity were to become a professional service provided by businesses to consumers. In such a scenario, one would expect a hub-and-spoke type of arrangement where a global network of nodes with large liquidity all open channels with one another, while individuals would have just a few channels open with these large liquidity nodes. A robust network of nodes each with large liquidity would allow individuals access to cheap and quick routing through deeper liquidity.

Further, if the above analysis on the need for custody is correct, then many people will prefer to avoid having to deal with many channels themselves. They will instead have their bitcoin held in custody by Lightning node operators who can also clear payments on-chain.

Trade-Offs and Risks

The move toward second layer scaling is one that involves risk for users individually, as well as systemic risk for the network. The first and most obvious trade-off is in the network’s censorship-resistance. Bitcoin has produced the only reliable technology for transferring value without reliance on intermediaries, and it only manages to do a few hundred thousand of these transactions per day. As demand for bitcoin transaction increases, and individuals resort to second layer solutions that rely on third parties to clear their payments, these parties will be able to censor their transactions and possibly confiscate their coins. One of the main advantages of the Bitcoin network is thus lost for individuals if they choose this type of second-layer scaling.

The second risk is more systemic to the whole network since it threatens the network’s protocol and consensus parameters. If bitcoin transactions move to second-layer solutions where many individuals are trusting third parties to validate their transactions and enforce network consensus rules, bitcoin deviates from being a peer-to-peer system. Consequently, the risk of collusion between nodes processing transactions rises. One can think back to the SegWit2x attempted “upgrade” and imagine a world where far fewer individual users ran their own full nodes. Had users been reliant on bitcoin businesses to enforce consensus rules, businesses could have succeeded in changing bitcoin’s consensus parameters. If the number of nodes declines, the remaining nodes become more influential and easier to co-opt by attackers or governments. A bitcoin network with a few hundred nodes is a far less immutable and secure network than one with tens of thousands of nodes.

The risk of losing censorship resistance is one that each individual needs to assess in contrast to the convenience and cost of other payment and custody options. The other risk is not directly the result of second-layer processing itself but rather a reduction in node count to the extent that it jeopardizes the decentralized nature of bitcoin. However, the Schelling point of bitcoin nodes agreeing on the main consensus parameters does not require every user to run their fully validating node. It requires enough independent full nodes to be active and enforcing consensus parameters to prevent any small group from changing these parameters in the direction that it chooses.

As Bitcoin scales, the challenge will be to introduce second-layer solutions that minimize both the trust in third parties and their ability to censor transactions. What is essential for bitcoin to survive is that the main consensus parameters, particularly the economic parameters, remain immutable. For that to happen, bitcoin needs many independent nodes that are unable to coordinate. The larger the number of nodes, the less likely it is that subgroups will collude. It is not strictly necessary for every individual to be able to verify each of their transactions on-chain for bitcoin to survive. If the growth of second-layer solutions results in a larger liquidity pool for bitcoin, and operating bitcoin full nodes becomes a profitable way to provide banking services, then it would financially incentivize the growth of independent nodes. This will make the bitcoin protocol more ossified and harder to change. Not only does the increase in the number of nodes make coordination more difficult, but the profit motive would likely make nodes conservative.

The good news is that Bitcoin does not need to be scaled globally on-chain. Bitcoin doesn’t have any competitors for trustless, automated, and censorship-resistant global clearance, and the only other asset that comes close to it is gold, whose movement is far more expensive and subject to confiscation, as discussed in TBSRB1. Bitcoin needs to be secure and decentralized enough to resist control and capture, and to establish a very clear, broad, and immutable consensus around network rules and money supply considerations. It does not need to accommodate your coffee transactions on-chain.