Money as Solution for Coincidence of Wants

Antal Fekete

People are free to choose anything as a money, but over time, some things will function better. The things that function better have better marketability, reward their users by serving the function of money better.

Cattle were a good choice at some point. Seashells, lime stones, glass beads, too.

Metals were a good choice when they were hard to make.

As they became harder to make, precious metals became money.

Later, only the most precious of metals, gold.

Why gold?

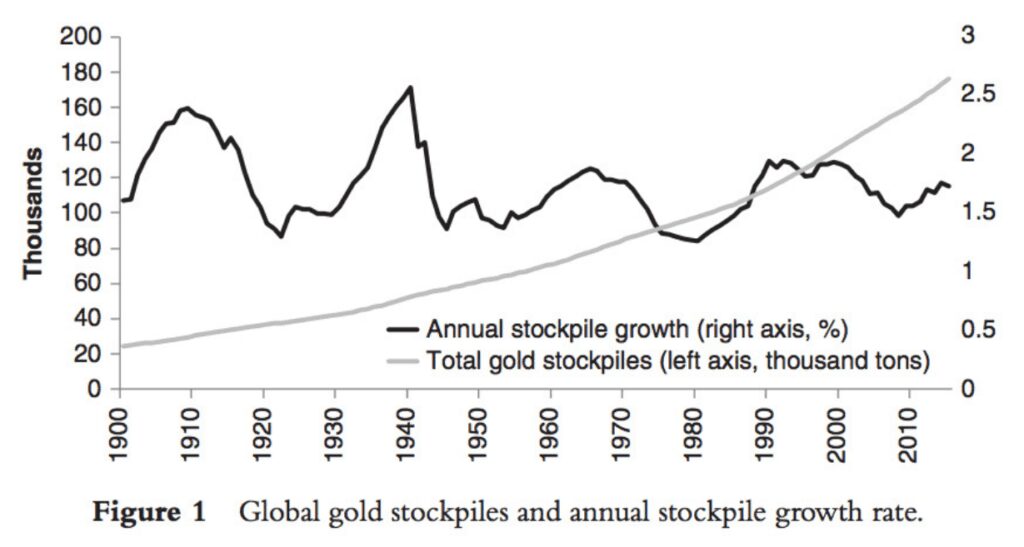

Gold was money because it has the highest stock-to-flow ratio.

Stock: all existing stockpiles that were produced in the past and are still available for the market. Ex: All gold produced up until year 2019.

Flow: New annual production. Ex: annual production in 2019.

Stock to flow = (existing stockpiles) / (new annual production) = 1 / (supply growth rate)

Why?

As monetary demand is added to industrial demand, the price rises. That stimulates more production. The metals with the highest stock-to-flow are the ones that will resist debasement through overproduction best.

Chemistry: does not corrode, and cannot be synthesized. This means gold production has just been piling up for millennia, never getting consumed. So annual production for any particular year is tiny compared to existing stockpiles.

Silver maintained its monetary role as long as it was needed for making in-person payments. As transactions moved to modern methods of payments like cheques and bills instead of the metals, everyone moved to the hardest money.

Hardest money wins. Whatever is hardest to produce gets used as money.

Modern industrialization has advanced to the point where we can make anything with the physical properties we desire. The only thing that matters today is the economic properties, in particular what governs the growth in supply.

Bitcoin is an incredible invention because it perfects the economic properties of money, while forsaking all the physical qualities traditionally associated with money.